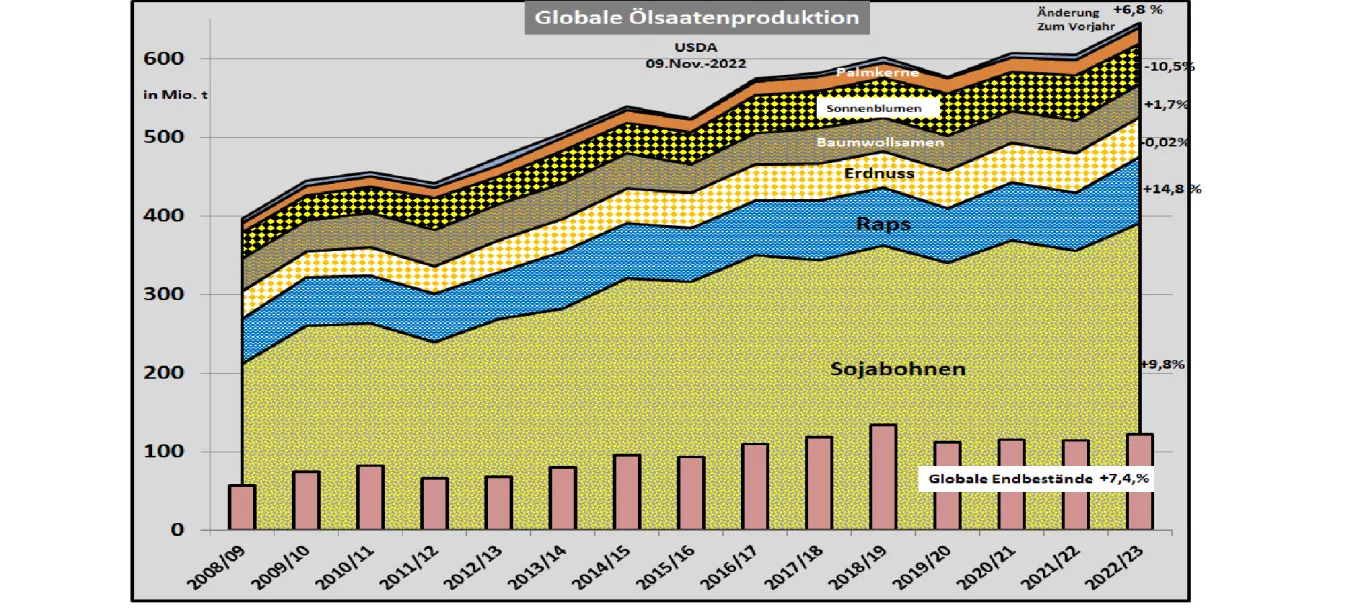

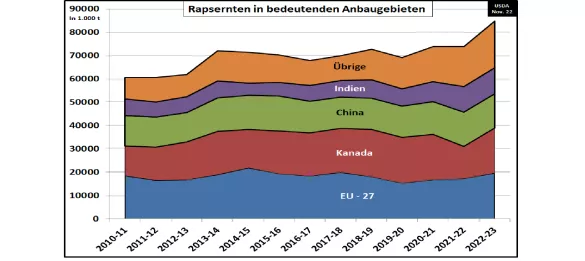

USDA estimates higher oilseed production in 2022/23 and higher consumption In its Nov 22 estimate, the US Department of Agriculture (USDA) forecast the oilseed harvest for 2022/23 to be 6.8% higher than in the previous year at around 645 million t. The ending stock will increase slightly due to the fact that consumption does not increase quite as much. Compared to previous years, the supply situation remains above average. Mathematically, the inventories are sufficient for 81 days, compared to 77 days in the previous year. The decisive improvement is due to higher harvests in the soybean sector. The USDA expects a worldwide increase from 355 to 390 million tons. The additional volumes are mainly due to the record Brazilian soybean harvest , which is expected to increase from 127 million tons in the previous year to 152 million tons this year. With 49.5 million t, Argentina did not reach the expectations of earlier monthly estimates due to the dry period. The US harvest in autumn was corrected slightly upwards again to 118.3 million t.Stable consumption trends for soybean are reflected in the entire oilseed sector, with the exception of slightly increasing ending stocks. China in particular stands out with unchanged imports of 98 million t or 58% of world trade. Chinese soybean production reaches 18.4 million tons. When it comes to soybean exports , Brazil is in first place with an expected volume of 89.5 million tons. The USA will have to reduce its exports somewhat in 2022/23 to 55.7 million tons. The EU cuts its soybean imports to 14.8 million tons; in addition, there are 16.8 million tons of soybean meal imports. The USDA increases global rapeseed production again to around 84.8 million t , which is 11 million t (!) more than in 2021. After the catastrophic previous year (13.7 million t), Canada is expecting a harvest of 19.5 million t and an almost doubled export of 7.95 million t. A harvest of 19.5 million t is estimated in the EU , the import requirement is estimated at 5.3 million t. Australia will have 6.6 milliont achieve the second highest rapeseed harvest, around 75% of which is exported. The drop in production of sunflower seeds in the Ukraine from 17.5 million tons last year to 10.1 million tons this year is causing a shortage of other oilseeds . The EU harvest also fell slightly by 0.8 million t. On the other hand, Argentina and Russia are increasing their production, so that the total volume decrease is limited. The USDA cut global palm oil production to 78 million tons (previous month 79.2 million tons). The reductions take place in the two main producing countries Malaysia and Indonesia with a production share of 84%. The unchanged estimated palm oil exports of the 2nd market leader in the market for vegetable. Oils (next to soy) are driving prices across the oilseed sector. The stock exchange prices fall due to the increasing supply.Prices for rapeseed and soybean meal have returned to their starting positions after the brief upswing of the past few weeks. However, the level remains above average.