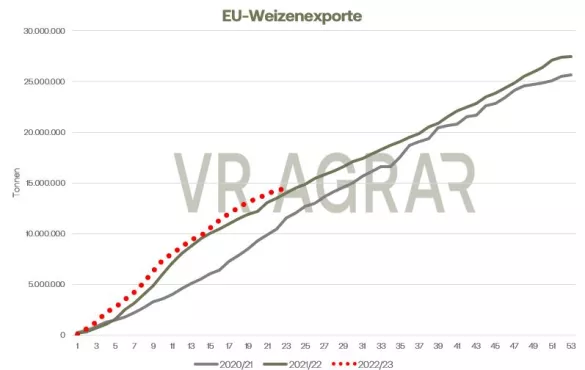

Both the Euronext/Matif and the CBoT went south for the wheat contracts on a weekly basis. Although the wheat prices in Paris managed to leave the respective trading session with daily gains from Wednesday, there is still a minus on the weekly view on both exchanges. The corn price in Paris, on the other hand, is almost unchanged. On the cash markets, the downward trend of the past few weeks has led to farmers increasingly offering their stored grain stocks for sale. However, sales remain at a low level. Feed mills are mostly well supplied with goods until February, flour manufacturers are also asking less wheat because consumer sales of flour do not correspond to the usual seasonal expectations. In addition, there is currently a lack of potential buyers from the Netherlands, but Swiss traders and buyers from Italy are also currently hardly looking for grain on the German market. Internationally, the demand for European grain looks different. Until 6.12. the 27 member countries of the European Union were able to export 14.486 million tons of common wheat. That is around 486,000 tons more than at the same time last year.Barley exports, on the other hand, are lagging behind those of the previous year, mainly due to the lower demand from China. Pressure on wheat prices continues to come from the Black Sea. Wheat export prices in Russia continue to fall, while Russian consulting agencies are reporting solid demand and above-average export figures for the country. The extension of the grain corridor for Ukraine also continues to have an effect, as it improves the global supply situation. The American export figures, on the other hand, are disappointing. The strong dollar continues to cause problems for exporters here. Reported export sales yesterday, Thursday, came in well below market expectations at 190,000 tonnes and export counts are well below last season's levels. The US Department of Agriculture (USDA) December WASDE is expected this Friday at 18:00 CET. The majority of market participants are anticipating an increase in ending stocks in the USA, but also globally. In Paris, the bottom line is that corn prices have hardly changed this week, but have clearly moved up and down on individual days.With a closing price of 291 euros/t in the front month of March 2023, the contracts quoted yesterday were at the same level as on Monday of this week. The imports of the European Union are still at a very high level. In the 23rd week of the current marketing year alone, 519,175 tons of corn were imported into the EU. The total volume in the current marketing year is now 12.6 million tons, more than twice as much as at the same time last year. At that time there were 5.77 million tons in the EU import statistics. The courses at the CBoT were able to increase in price this week. The export figures certainly provided support, but an increase in weekly ethanol production also caused prices to rise. Although ethanol inventories have also increased, they only limited the price increase marginally. For today's WASDE, market participants expect a slight increase in production volumes and global ending stocks.

ZMP Live Expert Opinion

Russia remains the key issue on grain markets. The good harvest there is causing export prices to fall, and the extension of the grain corridor for Ukraine is also continuing to put pressure on prices. Grain prices as a whole are therefore still under pressure at the end of the year, although they are unlikely to lose much of their volatility.