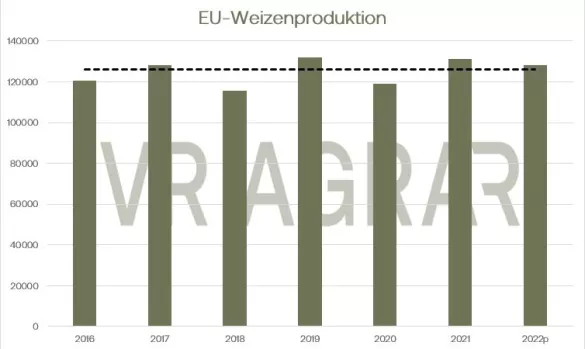

On a weekly basis, wheat prices on the Euronext/Matif have developed southwards. Red, albeit light red, signs are also showing in the wheat contracts this Friday. On the eCBoT in Chicago, the wheat futures also start with losses in the last trading day of the week. Maize in Paris is definitely moving from day to day, but has not changed on a weekly basis up to Friday noon. On the cash markets in Germany, corn prices are also unchanged or slightly firmer. The bread wheat prices as well as the quotations for fodder wheat increased slightly. As so often since February 2022, the markets are primarily looking at the Black Sea. Negotiations on the future of the grain corridor are ongoing. However, Russian representatives continue to be skeptical, as they feel that their positions have not been given sufficient recognition in the negotiations to date. The traffic jam on the Bosporus also causes a stir. Many freighters wait a long time for their inspection. The UN and Russia, together with Turkey, want to send new inspectors to Istanbul to release the agricultural freighters. In the Ukraine itself, more and more doubts are being raised as to how the coming season will fare.Many important agricultural areas are located in Russian-occupied areas, some of the recaptured areas have been mined and the country's logistics have been severely damaged. Fertilizers and fuels are difficult to obtain. The Russian Ministry of Agriculture drew up a preliminary harvest balance this week. According to this, 104.3 million tons of wheat were harvested according to bunker weight and are now pushing the market accordingly. Russian export prices are falling from week to week and are currently quoted at 312 US dollars per tonne, which is another 11 US dollars per tonne less than in the previous week. The sowing of winter wheat is sluggish. As of this week, farmers in Russia have planted 14.9 million hectares of wheat. At this point in the previous year, it was already 15.3 million tons. However, it is also possible that the farmers will order less wheat, since this year's harvest can hardly be accommodated in the storage capacities. In Europe itself, there is solid export demand for wheat, which is slightly above the volume level of the previous year. France and Romania remain, followed by Germany, Europe's largest wheat exporters. On the local cash markets, grain trading continues to run smoothly.Dutch traders are active in the north-west and south-west and are looking for feed grain for the first quarter of 2023. The EU Commission again lowered its harvest expectations for corn this week. Instead of the previously expected 55.5 million tons, there are now 54.9 million tons of corn that are reflected in the expected balance. In the previous year more than 74 million tons were taken from the fields. In addition to the weather conditions, a small area under cultivation across Europe is also responsible for this decline. The corn contracts on the CBoT fell slightly on a weekly basis. Weekly export sales largely disappointed the market. Good weather conditions, which should further speed up the harvest, are also a burden. The low water level on the Mississippi is problematic for American logistics. The ships can currently only pass the river there with a capacity of around 30%, which leads to extreme disruptions in the supply chain. However, the further increase in US ethanol production provided a boost, although ethanol inventories are also growing slightly.

ZMP Live Expert Opinion

It remains as it is: There is potential for falling wheat and barley prices due to the satisfactory European harvest and the currently low demand. The increasingly empty pigsties are also slowly but surely making themselves felt in demand. On the other hand, the situation and uncertainty surrounding the Black Sea grain corridor is keeping prices up. In the case of corn, the lower global harvest should continue to provide price support for the time being.