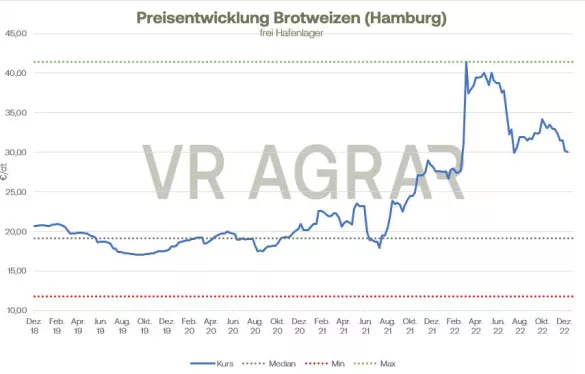

Over the past week, wheat prices on the Euronext/Matif have lost slightly. While the new front month of March 2023 was quoted at EUR 302.75 per tonne last Friday, the display board showed EUR 299.00 per tonne at the close of trading yesterday Thursday. On the CBoT, on the other hand, wheat prices increased on a weekly basis. Converted, the most traded March date in Chicago closed at 261.75 euros/t (757.25 US cents/bu), last Friday the March date cost the equivalent of 256.14 euros per ton. On the local cash markets, the prices for bread wheat fell by an average of 7 euros per tonne, while fodder wheat lost the same amount. The news situation this week was quite polyphonic. The December WASDE last Friday initially caused price pressure on both exchanges at the beginning of this week. The USDA cut the global wheat supply for the 2022/23 season from 782.68 million tons to 780.59 million tons. Due to lower consumption, especially as animal feed, the global ending stocks are falling much less than production and have hardly changed.The production cuts are mainly due to the drought in Argentina and lower crop expectations in Canada. For the European Union, the USDA expects a higher export volume compared to the November WASDE. Instead of the previous 35 million tons, the USDA now expects European wheat exports of 36 million tons. The message from France also fits in with this. The agricultural authority FranceAgriMer increased its own forecast for French exports to third countries by 300,000 tons and expects an export volume of 10.3 million tons. That would be another 17 percent more exports compared to the previous year. There was also more news from Russia this week that influenced price developments on the stock exchanges and cash markets. Exports are currently largely at a standstill. Storm fronts over the Black Sea meant that shipments had to be suspended in some Russian ports. At the same time, the Russian Ministry of Agriculture is planning to significantly increase the existing export quotas at the end of the season. Because of the very plentiful harvest this year and the associated problems with regard to storage capacity, the Ministry of Agriculture would also like to reduce the area under cultivation.The sowing of winter wheat and winter crops overall has recently been weaker in Russia due to the weather conditions and backlogged field work. Experts estimate the winter sowing area at 17.6 million hectares, compared to 19 million hectares in the previous year. Russia's attacks on Odessa earlier this week caused export volumes to fall in Ukraine as well. The port, like the city, was disconnected from the power grid for several hours due to drone attacks. The grain terminals were accordingly at a standstill. Surprisingly strong export sales buoyed the CBoT yesterday. Dealer expectations were clearly exceeded and the previous week's result was increased by 148 percent. Corn on the Euronext/Matif also fell on a weekly basis. The front month of March 23 closed yesterday, Thursday, with a closing price of EUR 284.50 per tonne. The negative indications for wheat caused slight selling pressure here. EU imports have now reached a volume of 13.13 million tons. The announcement by the Ukrainian Grain Union that a third of the corn plants could not be harvested provided price support. Although the USDA still expected a Ukrainian corn harvest of 27 million in the December WASDE,tons, but according to calculations by the grain union, the harvest should amount to a maximum of 24 million tons. In December's WASDE, the USDA cut corners again for global corn production. The situation in Ukraine in particular led to a reduction in production volumes, but experts from the US Department of Agriculture also corrected the EU corn harvest downwards again.

ZMP Live Expert Opinion

Grain prices remain under pressure. The supply situation is still on shaky ground. In Germany, demand on the cash markets should continue to be calm. In the case of bread grain, the closures of bakeries and underproduction in the baking trade are becoming more and more noticeable. At the level of feedstuffs, the clearly declining pig and sow stocks in Germany are also reflected in a lower demand for feed wheat.