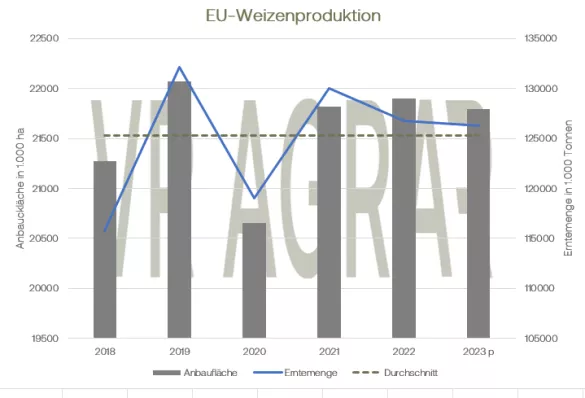

Over the course of the week, wheat prices on the Pairs stock exchange were volatile, but overall unchanged. While prices closed at 235.50 euros/t on Monday in the front month, they were 235.25 euros/t at the closing bell yesterday, Thursday. However, compared to last Friday, the prices are trending weaker. Corn was under pressure over the course of the week and closed yesterday's trading day at 205.00 euros/t in the November term that is about to expire. The following March date stood at 212.50 euros/t at the closing bell. Overall, wheat prices are under pressure. Demand on the cash markets remains manageable, but so is supply. At the wholesale level, prices for bread and feed wheat have fallen since last week. Barley is also traded weaker. Crown corn prices are also under pressure in this country due to the current harvest. In addition, offers from Hungary and France are increasingly coming onto the market, particularly along the Rhine and in southern Germany. The fact that the EU Commission recently estimated the quantities of the current season's corn and wheat harvest to be somewhat lower only had a limited impact on the markets.Higher wheat forecasts in Russia and Ukraine ensure that competition on the global market remains fierce. Relaxed news is certainly coming from Ukraine. There have been several reports this week of ships heading to Ukrainian ports to load agricultural goods and transport them to their destination countries. Russia recently had its Black Sea fleet moved from Crimea back to the Russian coast and no new attacks on Ukrainian port cities were reported. Many market participants see this as a signal of relaxation. Russia currently appears to be doing nothing to stop Ukrainian exports. However, a Turkish ship encountered a sea mine on Thursday but was able to continue its journey. It is still unclear whether this is a Russian mine or whether it is a remnant of the Second World War. An agreement was reached between Poland and Ukraine in the middle of the week in the dispute over grain exports. Ukraine is therefore allowed to use Poland as a transit country to transport wheat and other agricultural goods to Lithuania to be shipped from there. Europe's export statistics show weak demand compared to previous calendar weeks.Nevertheless, EU exporters expect good demand from Algeria, for example. Many traders are also in contact with Egypt and the recently weaker euro is benefiting local competitiveness. Corn imports remain below the previous year's volumes. Last week's US wheat bookings continued to disappoint, while corn exports remained solid.

ZMP Live Expert Opinion

Price jumps upwards cannot be ruled out: this is what the past week shows. Overall, however, the grain markets remain under pressure. The increased forecasts in Russia and Ukraine, the overall sufficient wheat supply in Europe and weak export reports as well as the ongoing corn harvest on both sides of the Atlantic are weighing on prices.