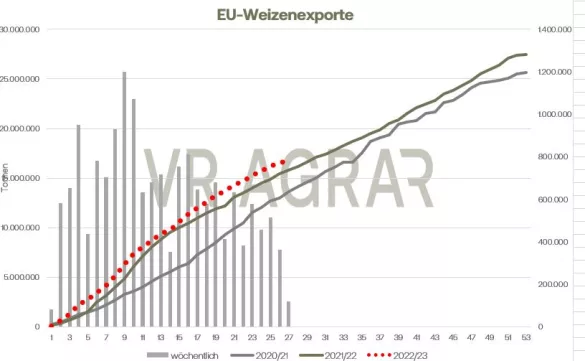

Wheat contracts in Paris started the new year with losses and price quotations on the local spot markets also developed weaker in the first calendar week of 2023. Although the front month of March 2023 closed yesterday with a daily gain of EUR 301.75 per tonne, it was EUR 7.50 lower than at the close of trading on December 30, 2022. Trading on the CBoT only started during the course of the day on Tuesday. This shows prices that remained the same until the closing bell on Thursday. The news situation for the new year is essentially unchanged from the previous year. European exports have slowed down recently, but at 16.7 million tons are still well above the level of the previous year. European dealers certainly have hopes of new contracts with current tenders from Tunisia and the Philippines. Robust labor market data in the USA have recently pushed the euro down again, making local prices more attractive. As reported by the Russian consulting firm Sovecon, Russian export prices around the New Year ranged between 307 and 311 US dollars and have therefore not fallen any further recently.In November and December in particular, Russian exports picked up speed and the analysts there are also optimistic for January. The competition on the Black Sea with low prices in the Ukraine and also lower Russian prices caused, among other things, the course setbacks in this country over the course of the week. The Russian statistical office estimated the 2022/23 wheat harvest at 102.65 million tons, of which around 72.6 million tons were winter wheat. According to estimates by the Ukrainian analysis company APK Inform, the area under cultivation in the Ukraine has more than halved to 3.8 million hectares. As the local Ministry of Agriculture announced yesterday, around 20 percent of the arable land in the war-torn country is either still mined or occupied by Russian troops. As in the previous year, the Argentinian grain exchange in Buenos Aires once again made cutbacks in the forecast for the current wheat harvest at the start of this year. The rains that have fallen recently are no longer beneficial to wheat stocks, but soybean plants can certainly benefit from the rain. The discounted level recently attracted bargain buyers, especially on the CBoT, to build up new long positions.The reclassification of US winter wheat stocks provided support. Compared to the last assessment at the end of November, these were again corrected downwards. This is also due to the very low temperatures around Christmas in the USA. Only 19 percent are in good or very good condition. Matif maize also made losses in the first week of trading in the new year 2023. The March date closed yesterday, like wheat, with a slight green sign at EUR 290.00, but has therefore been EUR 6 each since the first trading day of the new year lost a ton of value. EU imports remain at a significantly high level. By January 3, 14.66 million tons of corn had been imported into the 27 EU countries, doubling the volume compared to the previous year. 46.5% of the imported corn volumes come from Brazil, with the Ukraine contributing another 46.1%. All other suppliers of the European Union only account for less than 2.5% of total imports. Corn at the CBoT went significantly south.In particular, weak export shipments have recently been disappointing and ethanol production in the week after Christmas also showed a clear decline, but at the same time US ethanol stocks only fell slightly.

ZMP Live Expert Opinion

Competition on the world market is fierce thanks to low prices in Ukraine and a plentiful harvest in Russia. At the same time, economic concerns and the increasing spread of the virus in China are weighing on expectations for export opportunities.