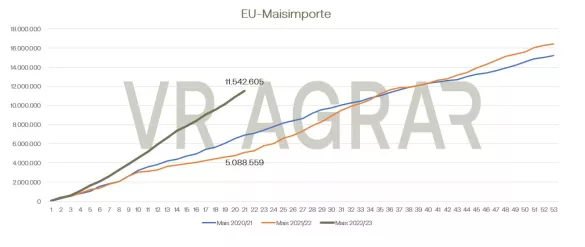

Wheat contracts on Euronext/Matif went south this week. When the currently most traded March contract closed last Friday at a closing price of 321 euros/t, yesterday it was 315 euros/t that was on the display board for this contract. On the CBoT in Chicago, wheat also went south on a weekly basis. The stock exchange was closed here on Thursday. Thanksgiving was celebrated in the United States. A look at the cash markets in Germany reveals a relatively unchanged picture. Producers are holding back goods in the hope that grain prices will rise again significantly. For their part, the buyers have also reduced their activities on the market due to the recent downward trend on the Euronext/Matif. Bread wheat delivered to Hamburg is currently quoted at EUR 343/t, feed wheat delivered to Südoldenburg at EUR 337.00 per ton. The listings have recently fallen here as well. In the southern regions of Germany, French buyers are increasingly entering the market, especially in search of A wheat and E wheat. These are also in great demand in this country.The wheat prices were supported by rumors that mills in Florida are apparently currently looking for wheat in Europe, especially in Germany, Poland and the Baltic countries. The US harvest obviously does not seem to meet the quality requirements. Brazilian importers are also looking for wheat because of the bleak prospects for Argentina's harvest. Traditionally, Brazil buys a large part of its needs in Argentina. But the country will probably fail as the main supplier. According to reports, Brazil is mainly looking for wheat in Russia. According to the United Nations, Ukrainian grain exports across the Black Sea are faltering. Due to the uncertainty about the extension, fewer freighters have recently made their way to the Ukrainian ports, and the inspections on the Bosporus are currently taking longer, also due to bad weather. The grain exchange in Buenos Aires (Argentina) yesterday once again confirmed its previous statements on wheat development there. Before the start of sowing, a harvest of over 20.5 million tons was assumed, but the current forecast is only 12.4 million tons. The effects of the drought are becoming more and more noticeable.Although there had been small amounts of precipitation, especially last weekend, this was not able to change the heat and drought stress on the plants. Corn also fell over the week. The front month of March closed yesterday at 303 euros/t. Last Friday, the Euronext/Matif scoreboard was still 306 euros. The spot market quotations also fell accordingly. EU imports have now reached a volume of 11.5 million tons. In the previous year, in mid-November, 5.08 million tons were still on the EU Commission's import counter. On the CBoT, corn also fell on a weekly basis. However, trade here was supported by increasing production figures for US ethanol. In the weaker environment of the grain markets as a whole, however, this did not lead to a price increase in the contracts on the CBoT. The US harvest is almost complete at 96% and corn stocks are coming off the fields earlier than last year.

ZMP Live Expert Opinion

After the 120-day extension for the Ukrainian grain corridor, prices are fundamentally under pressure. However, the outlook for Argentina and global demand continued to support the market. Wheat and corn do not seem to have found their footing yet. The potential for both rising and falling prices is there.