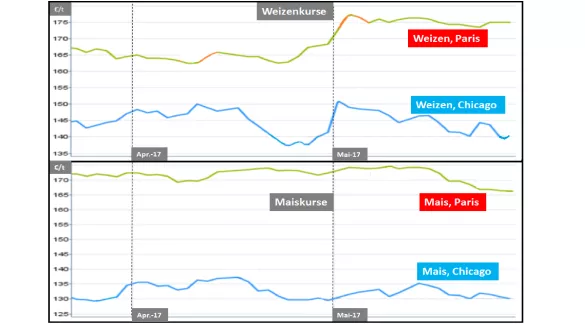

Above-average global supply situation but grain prices remain stable At the end of the 2016/18 cereals year, more than 500 million tonnes of grain or nearly 25% of consumption are to be superimposed, according to broadly consistent estimates . Such a stock should actually lead to weak courses. In fact, in short periods of time, the tendencies to the price of the goods are constantly being repeated, but they are picked up again in a short time. At the moment the Maiskursse in Paris have had to give up their monthly position above the 170 € / t-line and are now slightly above the 165-er mark. The pressure comes from the specifications of the Chicago listing.The real reason, however, is the favorable corn supply from Brazil, which is due to the fact that farmers are willing to get rid of their record-breaking corn crops in good time. And Argentina is still behind. Given the persistently intensive import requirements of the EU and the relatively strong price of the euro , the Paris exchange has to give way to international pressure. The later delivery dates in this year, however, show significant upturns. Last but not least, the assessment of a much weaker US corn harvest in autumn 2017 is behind. The US cultivation areas remain behind previous numbers in the penultimate sowing week.For the end result Is the area yield. The US maize harvest makes approx. 35% of the world. The wheat courses in Paris have been stubbornly fixed on the 175 € / t line since the beginning of May, while the Chicago quotations show weaknesses. Causes are the scarce overhanging stocks in the EU and the expectation that the coming EU wheat harvest is only estimated at medium. Harvest losses are already already visible in Spain and large parts of France and Germany. In the background, the downsizing of the US population is also on the order of 20%; But with a comparatively high dollar rate, the US export has only a chance with low wheat prices.However, for the EU , this year, with sufficient wheat quality, new export opportunities are opening up to traditional countries on the North African Mediterranean coast. However, there is also the competition from the Black Sea areas , whose crops do not promise the recall result of the previous year, but nevertheless a good average. The endings for wheat show a growing trend as the cereals are growing. The price signals predominantly speak upwards from a larger price margin. The reasons for price cuts lose their conviction.

ZMP Live Expert Opinion

Despite repeated weaknesses against the backdrop of high global overlay levels, grain prices remain relatively stable in a narrow range. For the further future, due to lesser harvesting expectations, it is more likely to see larger trading clearance in the rising and falling areas.