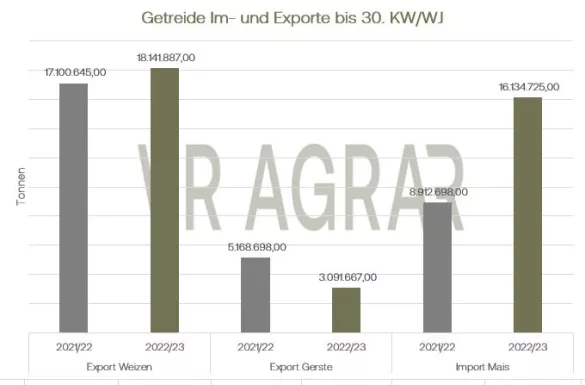

At the beginning of the week it looked as if the wheat contracts on the Euronext/Matif would remain true to their downward trend, the contracts went north again on Wednesday. On a weekly basis, there is even a plus of 4 euros per tonne. The corn dates also turned their direction and closed almost unchanged on a weekly basis. The futures on the CBoT were also firmer. Here, too, corn and wheat increased accordingly on a weekly basis. The reasons for the rebound are primarily to be found in Ukraine. After the German government announced on Wednesday that it would be supplying Lepard-2 main battle tanks to Ukraine, this gave the grain market a boost. Concerns about new escalations and thus also about a significant impairment of the global wheat supply have grown again and let the dominant concerns about the international competitive situation recede into the background. Yesterday, Thursday, the Ukrainian Grain Growers Association also announced that its experts are assuming a wheat harvest of a maximum of 16 million tons this year. In its January WASDE, the USDA still trusted the Ukraine to produce 21.5 million tons. In the previous year, at least 20 millionTons taken from the fields, according to the Ukrainian Ministry of Agriculture. At a conference in Paris yesterday, representatives of the USDA also expressed doubts about the harvest results in Russia. The Russian statistical authority Rostat increased the harvest volume to 104.4 million tons last week. USDA experts last saw Russian wheat production at 91 million tons in the January WASDE. The year-over-year changes and weather conditions during plant growth make such a large crop unlikely, according to the USDA. The data are said to be incomprehensible. Business trends on the cash markets in Germany are still calm. Lots are traded, but pricing is sometimes difficult because buyers and sellers have different price expectations. However, many market participants expect trading activities to pick up in the coming weeks. EU wheat exports remain at a very high level. By January 20, exporters in the 27 EU member states exported 18.14 million tons of common wheat, which is 1.04 million tons more than last year.However, barley exports are significantly lower, and the low demand from China is very noticeable here. Good US export sales have also recently provided support on the CBoT. Many market participants already see this as a trend reversal. For Europe, corn imports remain very large at 16.13 million tons. Only 8.9 million tons were imported at the same time last year. Little corn is traded on the cash market, also because producers are not willing to sell goods below 300 euros per ton. However, the overall supply situation is good and sufficient, because the high level of imports supports availability. In addition, the starch industry, particularly in south-west Germany, has very little demand for corn due to reduced production. The dispute over the import ban on genetically modified maize between Mexico and the USA has still not been resolved. The Ministry of Agriculture in Mexico recently announced that the country wants to be independent of maize imports and wants to significantly reduce import volumes by 2024 at the latest. Last year the country imported 16 million tons of corn, mostly from the USA.US ethanol production has continued to rise, but fuel inventories have increased as well.

ZMP Live Expert Opinion

The coming week will show whether the rebound is sustainable. But the signs have clearly turned. The Ukraine war is again more the focus of trade. Russia's export policy will not greatly restrict the supply situation itself, but will nevertheless support the price structure. The South American harvest is expected to change the wheat market only slightly, while corn has a much greater potential to influence prices, particularly due to better weather conditions in Argentina and high production prospects in Brazil.