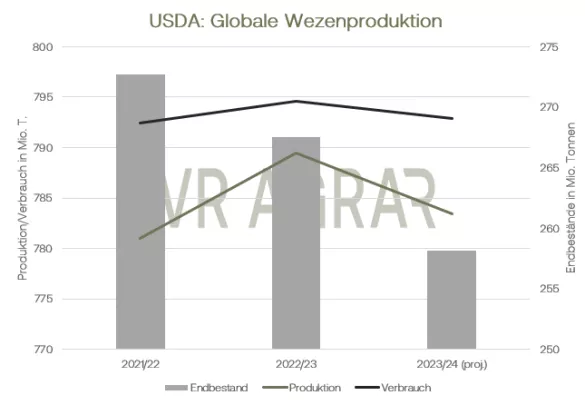

Wheat prices were under pressure again this week, but little has changed over the week. After the WASDE figures were published yesterday, Thursday, prices rose again and prices continued to rise in the first hours of trading this Friday. The situation is different with corn. The front month here trended yesterday at 199.75 euros/t, not only below the 200 euros/t mark for the second trading day in a row, but also 4 euros below the closing price from last Friday. On the CBoT, the prices for wheat and corn rose, especially yesterday, and are currently trading above last week's level on Friday. On the local spot markets, wheat and corn went south. Demand for wheat and corn on the local cash markets remains manageable. However, there is no real pressure to supply. The overall strong price competition on the global market also caused price pressure this week. This week it was announced that Egypt purchased 500,000 tons of wheat from Russia through direct purchase. Because of the bountiful harvest, Russia's warehouses are well stocked. Europe's exports have recently been lower.Nevertheless, the French agricultural authority has raised its forecast for the country's wheat exports to third countries to 9.8 million tonnes, up from the previous month's estimate of 300,000 tonnes. Better demand in France is expected, particularly from China. US exports, however, are falling short of expectations. The strong dollar recently further restricted the competitiveness of US exporters. The fact that prices are trending green on Thursday and today is due to the estimates from the monthly WASDE report. The USDA has corrected global production significantly downwards in the figures and now expects a harvest of 783.43 million tons (previous month 787.34 million tons). Consumption is also assessed as lower, but the assessment of global ending stocks has hardly changed. In the USA itself, more wheat is likely to come from the fields as yields per hectare have been adjusted upwards. There are significant losses in harvest expectations for Australia, Kazakhstan and Ethiopia. For each of these countries, the cuts are between 1.5 and 2 million tonnes. The European harvest will remain at 134 million.Tons expected. There is still harvest pressure for corn in Germany, which is impacting price developments on the Matif. Biogas plants are currently showing themselves to be absorbent and are accepting stocks whose residual moisture is too unattractive for drying at good conditions. Demand from the compound feed industry is cautious, and the harvest offering is supplemented by offers from France and Eastern Europe. In the WASDE report, the USDA raised the global harvest forecast slightly. For the USA itself, however, area yields and production volumes were reduced, which caused prices to rise. The USDA expects European production to be slightly higher, instead of 59.4 million tons it should be 59.7 million tons. Europe's imports are seen unchanged at 24 million tons. The forecasts for Ukraine remain unchanged. A harvest of 22.5 million tons is expected for wheat and 28 million tons for corn.

ZMP Live Expert Opinion

Concern about supply is not particularly pronounced in the WASDE report despite declining production figures. Ukraine's efforts to strengthen sea transport and international competition from the bountiful Russian harvest remain. The numbers from WASDE give corn and wheat a tailwind; the coming week will show how sustainable this price increase is.