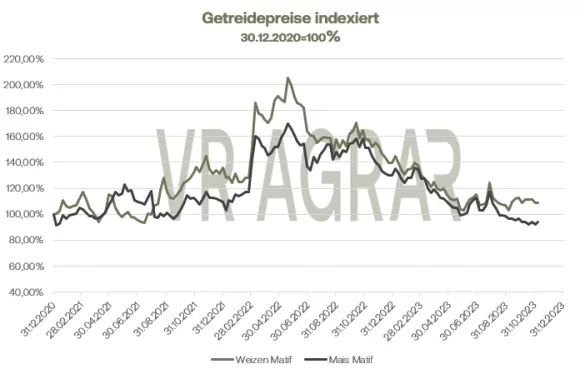

Overall, wheat prices on Euronext/Matif increased slightly over the course of the week. While the most traded March contract last Friday had a closing price of 225.75 euros/t on the stock exchange display board, it was 226.25 euros/t at the closing bell yesterday, Thursday. The March corn date closed yesterday at 199.25 euros/t and has therefore lost 5.50 euros/t in market value over the same period. Overall, trading on the cash markets remains manageable. Feed mills sporadically purchase short-term supplies. When it comes to wheat, discussions are underway for the coming harvest. Logistical problems arise, particularly in southern Germany, due to the weather situation. In addition, the high water level on the Rhine makes loading impossible at many destinations. Recently, Dutch buyers have been active in the feed grain market, particularly in southern Germany. In Europe, winter wheat sowing remains a problem. In France there has recently been some easing of tensions, but whether the originally planned area will actually materialize remains questionable. In Germany too, sowing has not yet been completely finished. Export demand remains manageable.The stronger euro is slowing down competitiveness. According to EU statistics, only 122,000 tonnes of common wheat were exported last week. Although the EU Commission points out that data from Italy and Bulgaria are missing due to technical problems, overall export volumes remain behind the volumes of the previous year despite almost the same harvest volume. The export count stands at 11.99 million tonnes up to the 22nd calendar week of the current marketing year. In the previous year it was 14.67 million tonnes and in the previous year 2021/22 there was also a significantly higher amount that could be exported at this point in time at 13.45 million tonnes. Europe's barley exports are only slightly below the previous year's level. Currently, 2.77 million tons were exported in the current marketing year, compared to 2.805 million tons in the previous year at the end of November. On the other hand, export bookings from the USA this week were surprisingly positive. China in particular bought larger quantities of wheat from the USA. The Middle Kingdom usually buys its wheat in Australia. However, the harvest there will be significantly lower than in previous years. The farmers there are busy with the harvest, but rain showers are currently increasing concerns about loss of quality.More and more analysts are expecting a significant shift from milling wheat qualities to feed wheat qualities. New forecasts for Canada's wheat crop are expected on Monday from Statistics Canada. Russia's Agriculture Ministry reiterated its expectations for high grain exports this week. The weather situation on the Black Sea is currently difficult, resulting in transport problems for Ukraine and Russia. Corn is also rarely traded on the spot market. Many market participants are currently looking at the situation in Brazil. The weather situation is returning to normal there. Nevertheless, due to the slow soybean sowing, the second corn sowing could be lower than previously expected. The US corn harvest is largely complete. Exports were positive this week, but declining ethanol production in the USA weighed on sentiment.

ZMP Live Expert Opinion

Wheat increased, but overall the grain market is under pressure due to better weather conditions in South America, the ongoing wheat harvest in Argentina and Australia and the large Russian harvest.