Contrary to the weak development on the other side of the Pacific, the futures on the Paris stock exchange were able to stay in the profit zone at mid-week. With another day in with a green sign, trading on the Matif for the wheat prices on Thursday came to an end. Hardly any old goods are handled in the cash markets. Some cover purchases are still taking place, but are mostly limited to a low level. The German Raiffeisen Association has revised its July harvest forecast downwards slightly to 43.8 million tons. Above all, the weather conditions were no longer optimal and were the cause of the correction. The severe storms caused significant delays in the barley harvest. The wheat fields have also suffered from heavy rainfall. In the region around the Eifel, losses of 20% are expected. The analysts at Strategy Grains have raised their harvest expectations for EU wheat to 133 million tonnes (+ 1.9 million tonnes). The experts also expect a later harvest. Exports were increased to 31 million tons. The Russian experts from Sovecon, on the other hand, have revised their harvest forecast downwards to 82.3 million tons. This corresponds to a decrease of 2.3 million tons.The main reason for this is the weak yields around the Volga region.

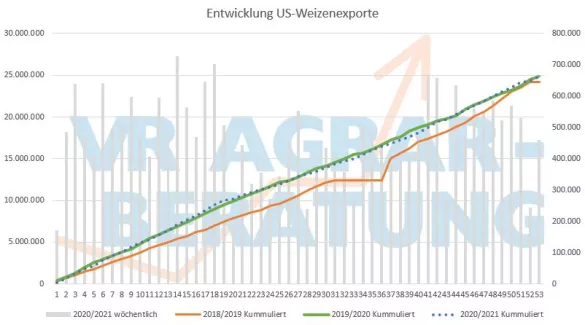

In the US, profit-taking and technical sales resulted in a slight price correction in wheat prices. Supported by the corn and soy market, the futures on the CBoT recovered and posted gains again. The USDA expects a 41% year-on-year crop decline in spring wheat. The general market expectation was only 25%. The harvest progress of winter wheat is 59%. The focus remains on the weather. In the Midwest, in particular, there is a lack of precipitation, so that the stocks still do not have optimal conditions. When harvesting the winter wheat, rainfall ensures that the machines stop again and again. US exports totaled 424,700 tons and were thus in line with expectations.

For the corn contracts in Paris, the signs in yesterday's trading were green. The August date recorded an increase of 3.25 euros / ton to 242.25 euros / ton. Many market participants report that the maize stocks in the German fields have developed well so far.A precise assessment of the storm damage is currently pending. Technical sales and profit-taking caused corn prices to decline in Chicago. Precipitation in some areas in the Midwest raised hopes for better yields, but the heat and drought in the north of the USA are also stressing the stocks. Meanwhile, the average ethanol production has been reduced to 1.04 million barrels per day. That is around 26,000 barrels a day than in the previous week. The inventories have reduced to 21.13 million barrels. Around 65% of the corn stocks are in good to excellent condition, according to the USDA. In the previous week it was 64%. In Argentina, the level of the Parana has fallen further and is causing restrictions in the logistics of agricultural goods. Meanwhile, the drought is keeping producers in Brazil in suspense. The maize fields clearly lack water. The result of the US export data with 133,200 was at the lower end of the expectation.