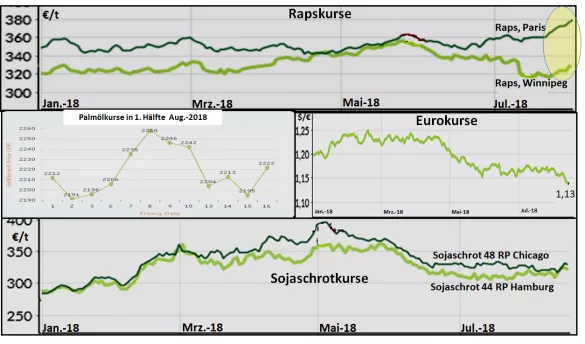

Oilseedcourse on Different Development Courses between Hope and Fear The announcement to start negotiations on US-China trade caused a short rise in soybean prices on the Chicago Stock Exchange. Canola prices in Canada went down, helped by fears of lower yields in the prairie provinces. The rape prices in Paris were additionally fueled by the weak euro. Also the palm oil courses attracted something temporarily. But the oilseed market is in a fragile state. Even in the upward trend, there are already the first setbacks.The vague hopes of possible better sales conditions in US-China soybean trade are being crushed by high US inventories and the expected US bumper soybean harvest in the coming months. The relative scarcity in the rapeseed sector is pushing up prices at every opportunity, but is being put under pressure by the low competitive prices of soya and palm oil . For the rapeseed prices on the Paris stock exchange, the mark of 380 € / t becomes an upper orientation line. In Canada, the threshold is around 500 Can $ / t Canola, which is often under or over. Fluctuating exchange rates play an important role in the rap courses. The palm oil prices are moving with moderate fluctuations in the lower price segment.High inventories and a seasonally increasing production until Oct / Nov. into ensure ongoing price pressure. Recently, the weak purchasing power of the currencies of larger importing countries such as India and China has been added as a price reduction factor. The above-average supply situation in the soya sector leaves no scope for higher prices. The situation will continue to worsen in the autumn, when the expected record harvest of just under 125 million t actually hits the market in the USA. Another stay away Chinese buyers could provide for even greater price pressure. In that regard, one clings to any prospect for possible increases in sales potential. Indeed, by the end of the year, China will reluctantly have to resort to larger US import volumes. A similarly potent soy supplier is not available.The oilseeds sector remains at least two- fold : scarce rapeseed supply on the one hand and abundant supply in the soybean and palm oil sector . The latter two are considered market leaders and dominate the price level.

ZMP Live Expert Opinion

Soybean and palm oil prices remain low due to the above-average supply situation. The relatively tight supply situation in the rape sector drives higher prices at every opportunity, but is repeatedly held back by the competition of the market leaders soya and palm oil.