Still, the market movement is oilseed prices looking for a ground-

If the global grain market already above average are well taken care appreciated, this is true for the oilseed market to an even greater extent. Accordingly, quotations have fallen sharply.

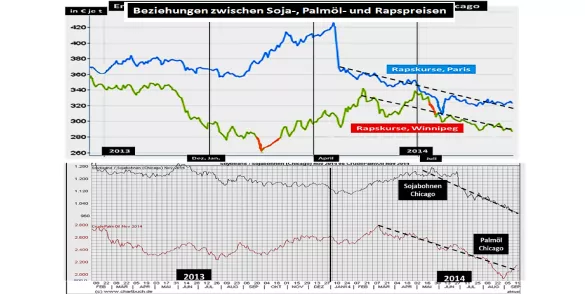

The rate adjustments in the oilseed sector are run but different speeds, but that had also his permission. When the soybean was a bottleneck in the connection supply of soybean meal until the beg. / mid Sept. 14 in, before the prices due to the expected record U.S. crop dropped significantly.

At the 2 market leader palm oil the courses have fallen significantly since the beginning of the year 2014 due to the large surplus stocks in the magnitude of a year production with intermittent breaks. The last downtrend has been corrected but again. The recent signs of recovery but remain at a low level.

After the century's bumper crop last year the canola prices in Canada have recovered back in their old cars. The parallel development of the Winnipeger and Paris rape prices signal a market equilibrium again. It does hardly a matter, that the this year's Canadian canola crop will be below average. Unfavourable conditions for sowing and growing conditions are still outbid recently by early snowfall. However:, the two market leaders, soy and palm oil rapeseed prices leave no chance to take a detached performance. The joint product of vegetable oils allows no great going it alone in the competition for the markets.

After stabilizing the prices of palm oil , it's now on the development of soybean prices. Where is the current U.S. crop in the Centre of interest. All the signs speak for a bumper crop above the 105 Mio.t brand (previous year t 89.5 million). A substantial portion of the soybean leaves already has thrown down, a sign of advanced progress from maturity. Even possible early frosts lose their terror, because no serious damage are possible.

In the course of the next main harvest date Oct. 2014 will prove to be, how far the price reduction potential in the United States can still be exploited.

The rare courses in Paris adhere ever dt brand still over the €30, after they were already times in the short term including. The forward rates for the next few months show may remain stable for the rest of the financial year but thats no guarantee when soy prices under the pressure of U.S. crops and South American successor should give further.

A Basic increase of level of price is not reasonable to infer.

ZMP Live Expert Opinion

After a long delay as a result of supply shortages in the soy meal sector To give to the oilseed prices across a broad front. The pioneer seems to have already reached a bottom base palm oil. In the soy complex, the actual introduction of the expected record U.S. crop will only trigger the possible price pressure, unless that unanticipated market disruption between them should come.

The prospect of subsequent high South American soybean crops in spring 2015 keep the future Kursentwicklug under pressure, even if they are to survive a number of risks from sowing to harvest.

Potential for price increases are currently not recognizable basic size.