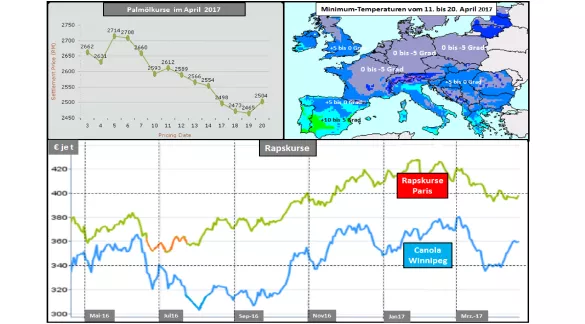

Crude oil be to different weather conditions in Europe and South America -, palm oil and soybean oil prices The impact of the coldest April night in Europe since the beginning of weather records is not manageable. To what extent of rape has taken damage, yet remains open. In any case the current growth projection is been compensated for the time being through the cold weather period. The course of developments in the oilseed business are currently by the lower crude oil price level on rd. $53 per barrel kept in the frame. To what extent the funding limits of the OPEC States can provide a stabilizing price level and remains uncertain given the political tensions with Iraq and Iran. The palm oil prices have eased due to the expectation of a production process estimated around 10% above the normal level in the lower middle. Until October, a seasonally normal monthly surplus generation is expected in any case. In the soy sector , prices for soybean oil have decreased. In conjunction with decline in Palm oil prices will to expect in the parts market of vegetable oils with a low-rate level be. The canola market remains still just supplied. To increase the intentions of Canadian canola farmers in their production by 4%, preclude a possible reduced crop in Europe as a result of the recent damage caused by frost. The rates of rape in Paris geared just below the €400 / t line. Much room for price will be upwards through the competition of other oilseeds and vegetable oils cannot be expected. The soy sector is currently again determined by the better harvest weather in Argentina. In Brazil, the soy harvest is approaching the end. A bumper crop of more than 110 million t seems to be relatively safe. This will in the coming weeks and months an urgent offer from South America put the US market under pressure. At the sale, the Brazilians show still a certain reluctance in the expectation of future increases in prices. In particular with regard to the actual U.S. acreage in may 2017 is speculation for now. Even the fluctuating exchange rate of the Brazilian currency plays a certain role.

ZMP Live Expert Opinion

Prices in the oilseed business are but framed by the crude oil and palm oil prices, but the weather development will provide for fluctuations in the near future. The production increase for Palm oil are promising, South American soybeans are to determine the market months, a larger area of U.S. soy is highly likely, the rape seed supply in the EU is critical. With ongoing price fluctuations in limited bandwidth will be expected.