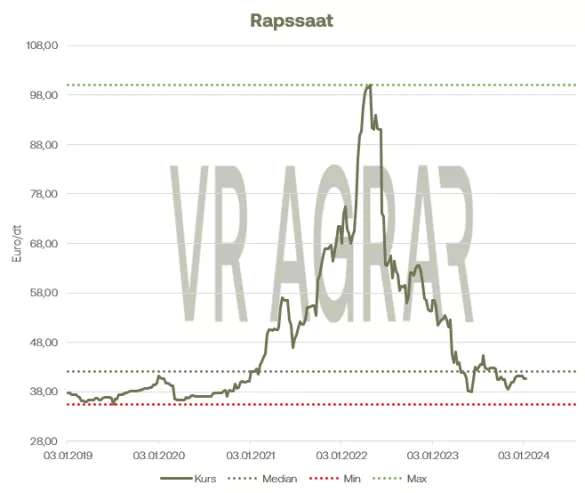

Rapeseed prices continued their upward movement on Thursday. With a profit of 7.75 euros/ton to 436.75 euros/ton, the front month made the highest profit. So did canola contracts on the Winnipeg Stock Exchange. With the support of rising crude oil futures, the contracts ended up in the green at the close of trading. After there was slight growth in global rapeseed production last year, analysts from the International Grain Council expect a decline in cultivation for the coming season. Accordingly, the cultivated area is expected to shrink to 42.4 million tons, which corresponds to a decline of 1.5% compared to the previous year. However, compared to recent years, the total cultivated area is still significantly above average. For the EU, cultivation is expected on an area of 6.0 million hectares. A decline in area is expected around the Black Sea, especially in Ukraine. Experts estimate the area at 1.6 million hectares. This corresponds to a decrease of 22.5%. In Russia, too, an area decline of 8.2% to 2.0 million hectares is expected.After the significant price decline in mid-2022 and autumn 2023, prices were able to gradually recover, but have recently shown a falling trend again. The soy complex was able to recover with the tailwind of the oil markets, which picked up again due to the geopolitical conflicts. Both the beans and grains contracts closed the trade with moderate profits. Market participants in the soy market are also eagerly awaiting the latest export figures from the USDA. Analysts expect a range of 400,000 to 900,000 tonnes for the current marketing season. The range for shot is estimated at 100,000 to 400,000 tons. Meanwhile, the Panama Canal operator said losses due to reduced shipping traffic could amount to $500 million to $700 million. Due to the extreme drought, there were repeated obstructions in the canal due to low water, meaning that significantly fewer ships than usual were able to pass through the canal.

ZMP Live Expert Opinion

After the pressure and losses on oilseeds, prices recovered shortly before the weekend. The contracts found support primarily in the rising crude oil markets. These had reacted to the increasing geopolitical conflicts. Whether the declining global rapeseed production will still play a decisive role will probably only become clear during the harvest. Until then, many market participants expect continued volatile market movements.