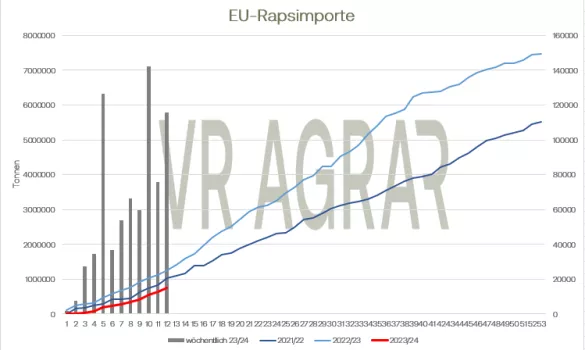

Rapeseed changed the color of its signs several times in the week that is now coming to an end and, like this year, showed itself to be soft with high swings in one direction or the other. On a weekly basis, prices on Euronext/Matif fell. While last Friday the most traded November contract was still at 444.75 euros/t, at the closing bell yesterday Thursday it was still 439.50 euros/t. The highest closing price was recorded on Wednesday at 449.00 euros/t. The Canadian harvest is in full swing and the farmers in the North American country are making good and rapid progress due to the weather conditions. Around half of the canola stocks have probably been harvested by now. Overall, the harvest volume in Canada is likely to be lower than last year. Both the USDA and Statistics Canada had already reduced the production outlook for Canada last week. CanStat recently expected a harvest of 17.4 million tonnes. If this result is achieved, the local harvest would be below the previous year's production. Europe's rapeseed imports are below the volume of the previous year. The EU Commission had recently expected an import volume of around 5 million tonnes for the current year as a whole. Up to the 12th calendar week, 748 have been received so far.510 tonnes imported into the European Union. At this point in the previous year, the import count was already at 1.24 million tons. New figures from the Union for the promotion of oil and protein crops show that Germany was able to export around 19 percent more rapeseed oil in the past financial year than in the previous financial year. The most important buyer of German rapeseed oil is the Netherlands, which purchased around 714,000 tons in this country. German exporters were able to gain market share, especially in Denmark and Norway. A total of almost 1.3 million tons of rapeseed oil were exported. In contrast to rapeseed, more soybeans were imported into Europe than in the previous year. By the 12th calendar week, 2.558 million tons of soybeans had reached European ports, compared to 2.36 million tons last year. However, soybean meal imports are declining. On the CBoT, Soja fell noticeably over the course of the week. Harvest has begun in the US but is being hampered by rain showers in the Midwest. Most recently, the USDA categorized the condition assessments down again by one percentage point based on the weather conditions in September and August. The issue of heat is currently also a concern for farmers in Brazil.It is currently over 40 degrees regionally warm and the current soy sowing is threatened right from the start. As the local agricultural authority CONAB announced, it is expecting a higher harvest than last year. Due to a significant expansion in area, especially at the expense of corn, CONAB is assuming production in the 2023/24 season of 162.4 million tons, once again setting a new record. The cultivated area is expected to increase by another 5.1 percent compared to the previous year. Brazil is currently selling large quantities of the last record harvest to China. As the People's Republic's import statistics show, 9.9 million tons of Brazilian soybeans were imported into the Middle Kingdom in August alone. However, US export figures this week disappointed the market overall. In addition, retailers struggled to remain competitive due to the renewed strength of the US dollar. Overall, the US soy market remains torn between an overall weak market environment for agricultural goods, concerns about soy stocks and crop quality, and international competition.

ZMP Live Expert Opinion

Canada's canola harvest and high production expectations for Ukraine are currently creating pressure. The recent decline in soybean oil and palm oil is further reinforcing the trend in rapeseed. In the soybean market, the beginning of the harvest in the USA and high expectations for the coming Brazilian harvest are also creating selling pressure. Even though many uncertain factors accompany the oilseed markets, the overall signs point to weaker trends in the coming days.