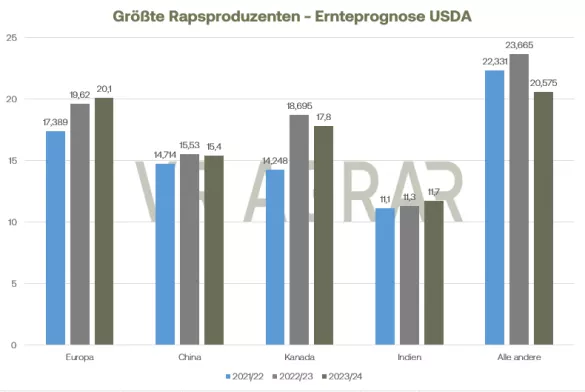

Initially, the rapeseed contracts had a positive start to the week and continued the upward trend of the previous week. From the middle of the week, however, the bulls weighed on the market and prices fell back to 430.00 euros/t in the front month of February. This means there has been a loss of 11 euros per ton since the closing bell on Friday. In the most recent WASDE, the USDA increased its forecast for global rapeseed production, which initially only marginally concerned the market. The production forecasts for Australia and Canada in particular were increased. Rather, falling crude oil prices and a higher acreage estimate for France provided selling arguments. The declining trends on the soy market also caused price pressure. According to the French agricultural authority, France's farmers have increased the area under rapeseed for the third year in a row. It is expected that the oil crop was cultivated on an area of 1.35 million hectares, an increase in area of 0.5 percent compared to the previous year. On average, the cultivated area in France has grown by 17.4 percent in recent years. In Ukraine, on the other hand, a decline in rapeseed cultivation area is expected.As the Union for the Promotion of Oil and Protein Crops announced, rape cultivation is likely to be lower due to war, high production costs and a lack of workers. The revenue opportunities for local producers were poor this year too. On the other hand, it is assumed that farmers will be able to grow more soy and sunflowers. After some back and forth, soybeans were able to gain on a weekly basis. The weather conditions and weather prospects for Brazil caused both ups and downs this week. Recently, the weather conditions had improved and farmers can expect heavy rainfall. This led to significant losses in soybeans and soybean meal, especially on Wednesday. Soybean sowing has still not been completed and, according to the latest estimates from the agricultural authority, 90 percent has been completed. In addition to the USDA in the December WASDE, the consulting firm Safras and Mercardo also significantly reduced its forecast for the harvest this week. Instead of 161.4 million tons, the consulting firm now expects a soy harvest of 158.2 million tons. In addition, the significant decline in crude oil prices also had a temporary impact on soybean prices. The new government in Argentina has significantly devalued the peso.Competition in the soy export market is likely to increase significantly for the Americans. Due to the smaller than average harvest last season, Argentine soy products currently play a smaller role in global trade. On the other hand, export demand is positive despite the price competition due to the last harvest in Brazil. The USDA was able to announce large individual sales several times, which provided price support.

ZMP Live Expert Opinion

The news for oilseeds, like trading trends, is varied and volatile. Further developments in Brazil on the one hand and export demand in the USA on the other remain decisive.