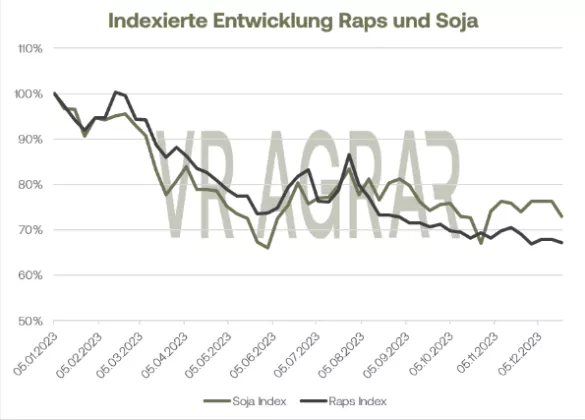

Rapeseed fell slightly again in the week that is now coming to an end. Overall, the oilseed markets were under selling pressure. Soya in particular fell due to improved weather prospects in South America, thereby also weighing on rapeseed and canola. Nevertheless, the prices yesterday and the day before yesterday were able to escape the negative trend from the CBoT. The market is supported by the latest figures from the Federal Statistical Office. Accordingly, the current winter rapeseed area in Germany is 1.1 million hectares, around 4.7 percent lower compared to the previous year. In addition, regionally very wet soils cause problems for the stocks. Further rainfall is also predicted in many regions in the coming days, and there is even a risk of a storm surge on the North Sea coast. As expected, little has changed on the cash markets. However, there is also solid demand for rapeseed meal this week, although supply quantities remain low. The latter are likely to remain in short supply in the next few weeks. The rapeseed oil prices are slightly lower in a weekly comparison, but the food retail sector in particular is in negotiations in this country. Soy was mainly influenced by the better weather conditions in Brazil and was weaker compared to the previous week.Good export sales last week failed to turn bears into bulls. With its large harvest last year, Brazil continues to compete with the Americans on the world market. Even though the short-term weather prospects have improved, there are now increasing forecasts that predict production volumes for the coming harvest in Brazil will be well below the 160 million tons mark. The USDA had recently calculated 163 million tons for Brazil. In Argentina, sowing continues to make progress and farmers are generally satisfied with the development.

ZMP Live Expert Opinion

Chinese export demand for soybeans remains high. At the same time, more and more analysts are reducing their expectations for the Brazilian harvest. The coming weeks will be decisive as to how well the plants in South America can develop. The pressure to sell on the CBoT and on Euronext/Matif seems to be holding for now.