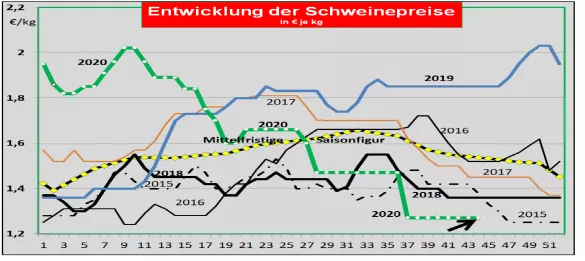

Germany: The living supply continues to increase. Prices unchanged. The slaughter numbers of the previous week rose again to 828,103 (previous week 822,635), the slaughter weights are already 98.8 kg . The pre-registrations for the current week have fallen significantly with 331,000 (previous week 362,660) and provide little relaxation. Hopefully it will be possible to keep the supply backlog within limits by increasing slaughter capacities. When reselling the cuts to food retailers, processors and for export, the average prices were set back slightly. Shoulder and chops were rated slightly lower. The meat trade is stable. Slaughter by-products are more difficult to find in the market. The export business has collapsed due to the ASP-related bans on Asian importing countries.One problem is the accommodation of the parts typical for third country exports. The V price remains for the 44./45. KW 2020 stand at 1.27 € / kg. Up to now 94 wild boars infected with ASF have been officially confirmed in Brandenburg. The restriction areas are fenced off. The search for fallen game with drones, dogs and firefighters continues. Domestic pigs are not affected. Market and price development in selected competing countries: In Denmark the prices in KW 44 will once again be kept unchanged. Exports to the domestic market have become more difficult due to limited sales opportunities, mainly in Germany. The third country export is running. In Belgium the prices in week 44 remained unchanged at their low level. The sales opportunities in the EU internal market are more difficult for Germany because of the ASP-related export ban.Netherlands: The slaughter companies did not change their prices in week 44. Live exports to France (approx. 11,000) and Germany (3,000) remain below the usual figures. In France the number of battles has declined; some games were rejected. The prices in Brittany were set back a little at 1.35 € / kg . Meat imports from neighboring countries narrow the sales and price scope in France. In Italy the prices have fallen by -4 ct to approx. 1.51 € / kg dropped. The demand decreases in the post-holiday period and due to the coronvirus. Rising imports are putting pressure on prices. In Spain the prices are converted by 1 ct to 1.70 € / kg. The supply increases depending on the season. Deliveries from other countries have an impact on prices. China exports are going well. In the USA , producer prices in IOWA have fallen to € 1.17 / kg . The new front month of Dec 2020 is only traded at 1.26 € / kg on the Chicago Stock Exchange. The fluctuating dollar plays a role in the conversion. Rising live supply and reduced exports as well as coronavirus-related limited slaughter capacities are the causes. In Brazil , with the support of the currency, prices have risen to € 1.80 / kg . In the local currency, prices are at the top level. Here, too, one benefits from growing export business, among other things because of the ASP delivery blocks for Germany. China: The average prices are converted to approx. 5.33 € / kg fallen. The demand has adjusted downwards due to the circumstances. A slight increase in domestic supply is noticeable. The blocked German deliveries are offset by replacement imports from other countries. Imports are at an unusually high level.CONCLUSION: The pork congestion in Germany is becoming more critical. Piglets cannot be moved to the required extent. The backlog is putting pressure on piglet prices. In contrast to summer, the usual seasonal increase in supply in the live cattle sector has to be coped with. The so-called second wave of coronavirus infections is causing concern. In contrast, the fresh meat offer is not too plentiful. Valuable parts for processing are in demand. The so-called 5th quarter, however, is difficult to accommodate in the market because of the ASP-related German bans in third countries.

ZMP Live Expert Opinion

Too low slaughter numbers, too high slaughter weights, persistent supply pressure and inadequate third country exports characterize the continued critical situation in the slaughter pig market. Low expectations of falling pre-registrations and hopes for expanded slaughtering capacities make it easy to relax without solving the problem of the supply backlog.