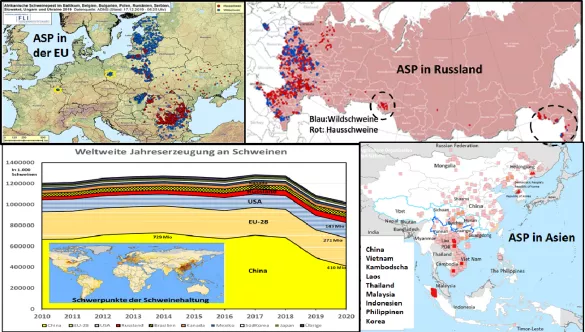

The pork market at the turn of the year 2019/20 - what can be expected in 2020? The global pork market is currently dominated by African swine fever (ASP), which has destroyed 25% of the global pig population. The main focus of the disease is in China , where at the end of 2019 only around 45% of almost 650 million pigs in 2018 are said to be present. In neighboring Vietnam , 20% of the pigs were killed. The ASP continues to spread in other neighboring Asian regions such as Cambodia, Laos, Indonesia, the Philippines and South Korea . In Europe, the ASP centers are located in the Baltic countries and NO Poland, with a focus on the wild boar population, and in the south-eastern European regions of Romania and Bulgaria, with a focus on domestic pig stocks. In addition, the disease is widespread in large parts of Russia .Two outbreaks in Belgium and in western Poland near the German border represent an increasing threat to local pig farming. As a result of the international trade in pork, the ASP-related drop in stocks has an impact in all participating countries. In China , due to a lack of pork supply of approx . 20 million t (corresponds to almost the entire EU production) the prices of approx. 2.50 to 6.50 € / kg at the top. Pig prices in Vietnam have doubled. Since the EU Covering 2.4 million t or more than 50% of the rapidly increasing Chinese import demand, the prices in Germany also increased from 1.45 to 2 € / kg. The course development was exacerbated by a decline in pork production in the EU. Germany, Spain, Denmark and the Netherlands are at the forefront of the China business.Brazil's pig prices are also benefiting from export-related price increases from the original 1 to 1.70 € / kg . Measured in terms of total exports of 0.9 million t, (thereof 0.25 million t to China) , however, Brazil lags behind other export regions. On the other hand, the USA could deliver on a large scale due to its 25% increase in pork production in the past 5 years and current pig prices below 1 € / kg . But the widespread use of growth promoters and Chinese punitive tariffs in the trade war between the two countries limit US exports to China. For 2019, the USA will reach approx. 0.5 million tons of pork exports to China. Canada, with an export potential of 1.3 million tons of pork, has also been hampered by a political dispute over the Huawai company in China. In the meantime, partial solutions are said to have been negotiated.Canadian deliveries to China are estimated at 0.3 million tonnes in 2019 . Russia's large companies are making every effort to start exporting to China after the self-sufficiency rate has exceeded 100% and domestic prices are under pressure. So far, however, China has not issued import licenses for Russian suppliers. What can be expected for 2020? Although every effort is being made to curb the spread of ASP, it can be assumed that reinfections will occur. Despite the first approaches under laboratory conditions, no practicable drug against the virus should be available in the short term. According to experts, 2020 will be the lowest point in pork production for China . A further reduction in Chinese pork production is estimated at less than 35 million tons . In 2018 it was 54 million t. Imports are expected to reach 4.5 million tons of pork, approx.2.3 million tons of beef and 1.5 million tons of poultry are increasing. Only a significant reconstruction of the sows could lead to more piglets or fattening pigs. The reassembly takes 1.5 years until additional pork is available again. In addition, Chinese own production of poultry, beef and fish is to be strengthened, but is reaching its limits. In the case of beef, there are only a small herd of milk and cattle in poor locations in the north of the country, which can only be mobilized slowly and to a limited extent. When it comes to poultry , there is a bit of a hold back due to bird flu . A full compensation cannot be achieved with increasing own production and imports. In the other affected Asian countries , the loss of production will also continue, in some regions an expansion may be imminent. The risk potential in Europe is also not diminishing. Who can deliver how much?The EU-28, with 3.5 million tonnes as the largest export country to date, expects pork production to decline overall in 2020. In the traditional strongholds in the northwest of the EU-28, increased environmental and animal husbandry requirements are preventing an increase in animal populations. In the Eastern European regions, the ASP leads to a sharp decline in stocks. However, the decrease in domestic consumption creates some scope for exports. In Spain alone, rising production and corresponding export increases are expected. The USA, with 2.5 million tonnes as the second largest exporter, will increase its pork production by another 3% in 2020, according to the latest inventory counts from Dec. 1, 2019. With only moderate domestic consumption increases, more meat is available for export. Mexico traditionally receives a good third, another third migrates to Asian countries such as Japan, South Korea, Indonesia and the Philippines; an increasing remainder is available for export to China.As a precaution, several large companies in the US pig industry have decided not to use growth promoters. The recent cuts in Chinese punitive tariffs on US goods include pork, but tariffs only drop from 72% to 68%. In anticipation of growing business in China, the forward prices for pork on the Chicago Stock Exchange rose to over € 1.70 / kg for the summer months of 2020. Following the settlement of the political dispute over the Chinese Huawei company, Canada is also ready with an export potential of 1.3 million tons, of which China will increase to 0.3 million tons. However, the Canadian pig population is only increasing moderately. Brazil, as the leading export country for beef and poultry, benefits from Chinese meat imports in several sectors. For 2020, pork exports will exceed the 1 million t mark for the first time, of which 0.35 million will go to China alone. Brazilian pig prices have already risen from under € 1 to € 1.70 / kg.Russia is urgently expecting pork to be imported into China. Russian self-generation goes well beyond self-sufficiency and is depressing prices. However, the export potential remains comparatively low within the range of 0.15 to 0.2 million t. Conclusion: The global import requirement for pork with China at the top will increase in 2020. The exporting countries will increase their deliveries, but will not be able to fully meet the needs. Increasing replacement by other protein carriers such as beef, poultry and fish are also not enough to compensate for the immense loss of production in China and neighboring countries. As a result, the global supply situation with (pork) meat will be scarce in 2020 and lead to persistently high prices. Don't forget: African swine fever remains a serious threat in Europe.

ZMP Live Expert Opinion

The Chinese loss of pork production cannot be fully replaced in 2020. The global supply situation is exacerbated by ASP outbreaks in other Asian countries. There is still a considerable excess of demand. Deliveries from all over the world are reducing the supply of pork in the countries of origin and will lead to persistently high prices in 2020. The EU remains the largest exporter ahead of the USA, Canada and Brazil. An end to this market situation for the next few years cannot be reliably predicted. It will take years to rebuild stocks, provided the disease is under control.