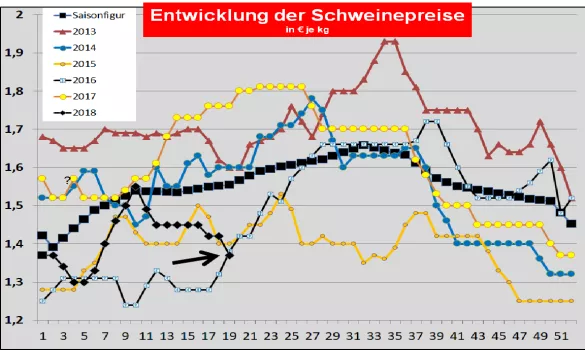

Pig prices for 18./19. KW-2018 The ISN Internet Auction on 24th April -18 delivered an average price of € 1.47 / kg in a range of € 1.46 to € 1.47 / kg and a projection of 42%. On May 1, there was no auction. General market and price developments: Pork prices are being affected by international price and sales weaknesses. Despite barbecue weather and a restrained live offer, the courses give way.In the importing country of Italy, the price declines since the beginning of April have seen a decline of approx. 20 ct / kg. Germany, with a pork surplus of 20%, is feeling the price collapse of Italy particularly strong. In Denmark, Spain and France, the courses are on the spot. in the US, there are clear signs of stabilization. Denmark: Danish pork prices remained unchanged for the 18th week of production 18. For the upcoming 19. KW base prices will continue to be updated unchanged . In France / Brittany , the quotation was raised by 0.4 ct / kg on 30.04. The battle figures are 389,118 (last week 381,293 last week 385.760) Piece further above average. The Dutch slaughterhouses paid between 2 and 3 cents / kg in the 18th KW-18 . Belgium: Pig prices were paid unchanged in the 18 KW-18. Germany : For the 18./19. KW-18 , the merger price was lowered unchanged to € 1.37 per kg or index point .The range is from € 1.37 to € 1.42 / kg. The pre-registrations fall with 224.778 (previous week 219.700 before last week 226.900) piece again higher. Last week's battle numbers are at an annual average of 1,008,433 (previous week 987,948 before last week 894,869). The applicable in Austria fattening pig base price is for 18./19. KW-18 reduced by - 5 ct / kg. The pig prices in Spain are on Thu, 26.04. remained unchanged.In (Upper) Italy pig prices on 30.04 in Modena were reduced by -2.5 ct / kg , on Tues in Reggio - 2.5 ct / kg and Cremona -0 ct / kg . The battle numbers lie with 45.711 (previous week 45.721 before last week 42.416) piece in the upper average range. In Poland on 20.04.2018 the pig prices at 57% MFL increased slightly to the equivalent of 1.414 € / kg . Outlook: A repeated series of party and bridging days leads to a difficult-to-understand development of supply and demand. Price pressure comes from the export business both in the domestic market and in the third country trade. Pork prices in China, Brazil and Canada remain at a low level, while in the USA, a strong price increase of 0.83 to around EUR. 1.10 € € / kg can be determined. Uncertainty remains as a result of disputed US trade policy. The US prices are on 02.05.18. in IOWA increased to the equivalent of € 1,096 / kg . According to the latest survey results, the US consumer confidence index is at a remarkably high level.Chinese import duties have been partially offset by replacement exports to Southeast Asian countries. The stock market quotations in Chicago for the front month of May 2018 have risen to 1.24 ct / kg. For the barbecue months June / July / August, further increases up to 1.35 € / kg should follow. China's porcine quota fell back on April 25, 2018 to the equivalent of € 1.85 / kg . Rising living supply from new fattening systems meets seasonal low demand. The failure of US imports has barely made itself felt. The high EU export figures to China are lower this year. The currently uneconomically low Chinese price level will lead to further operating tasks of the traditionally small units and slow down investment. Price stabilization is not yet apparent.The Russian pork prices stopped on 25.04.2018 at 1.86 € / kg . Alone in the months Jan / Febr. In 2018, pork production was 11% up on the same period last year. When converting, the purchasing power loss of the Russian currency ruble also contributes to the price trend. Brazilian pork prices have stalled on 02.05.2018 on average in the southwest region at the equivalent of 0.92 € / kg . The sharp decline in exports from Russia and the international competition from the USA and Canada are putting severe pressure on the Brazilian pig market.The Brazilian Real has lost some of its purchasing power.

ZMP Live Expert Opinion

Weak meat exports in the domestic market and in third-country trade gain the upper hand when it comes to pricing compared to seasonally below-average battle numbers and the upcoming barbecue season. Even a yielding Euro course does not really help. Even the significantly higher US pork prices are not having any effect in this country. The celebration and bridge days in a row contribute to the uncertainty of the market development. Slaughter days fail; more free time could contribute to more consumption. Or?