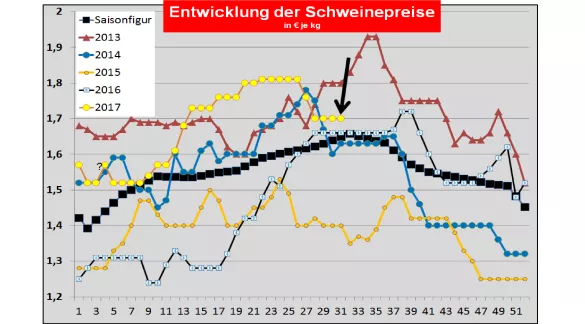

Pig prices for 31/32. KW-2017 The ISN Internet webcast on Tues, 1 August 2017 provided an average profit of 1.74 € / kg for a range of 1.71 -1.755 € / kg. The offer was 2,425 pigs. There remained a supernova of 10.7%. General market and price trends: The sluggish sales in the meat sector continue to continue as a result of holidays. The slaughter numbers and the battle weights remain below average. In Spain, the high price level reached (1.91 € / kg) leaves no room for maneuver.In Italy leads The traveler demand to larger sales opportunities to still slightly rising prices. Austria also benefits from the holiday season. In France, the supply-demand ratio is balanced. In the US, pork prices have reached their summer peak. Brazilian pig prices have continued to recover at a low level. Prices in China remain at a low level. China's pork imports continue to decline. Chinese consumers consume less pork in the context of a "health-oriented diet". Denmark: Danish pork prices were raised in the 31st century . KW.-17 maintained unchanged The slaughter figures are -6.2% below the previous year's level. For the coming 32nd KW-2017 , the prices will remain unchanged. In France / Brittany was The quotation (03.08.) Remains unchanged .The reported slaughter figures for the whole of France are included 351,774 (previous week 354,469 last week 304,935) pieces continue in the lower midfield. The Dutch slaughtering companies paid unchanged in the 31st KW . In the 32nd KW 2017. , , , , Ct / kg can be paid.(Addendum) Belgium: Pig prices were maintained unchanged in the 31st week . The quotations of the slaughter companies are for the 32nd KW 2017 ....... Ct / kg.(Supplement follows) Germany : The slaughter numbers reach 939.589 (previous week 9 58.853 pieces previous week 958.309). For the upcoming period from Thursday 03.08. Until Wednesday 09.08. (31/32 KW-17) , the association price was maintained at € 1.70 per kg or index point .The range ranges from 1.70 to 1.70 € / kg. The announced deliveries of the next week will not be significantly higher at 217,800 (previous week 216,500 previous week 212,000). The fattening pigs' basic fare in Austria, which was valid for the 30th / KW remained unchanged. The pig offer falls Measured in terms of holiday-related extra mile. For the 31st / 32nd KW should be retained. The pork prices in Spain were published on Thu, 27.07. Remain unchanged. In (Upper) Italy are pig prices on 31.07.In Modena at +0.5 ct / kg , at Di in Reggio +0.5 ct / kg and Cremona increased again by +2,0 ct / kg . The slaughter figures are included (Previous week 40.554 previous week 40.668) pieces in the bottom Midfield. In Poland on 21.07.2017 pork prices at 57% MFL of 1.65 € / kg were quoted. Outlook: The demand for meat in the northern regions of Europe remains low due to the holiday / holiday season. In the southern holiday countries, demand remains buoyant.Pre-registrations in this area continue to point to below-average levels Slaughter numbers for the current week. The US prices are on 02.08. To 1.50 € / kg .The stock exchanges in Chicago for later delivery dates in late summer and autumn Indicate a strongly downward tendency. In the autumn months prices are expected to reach 1.15 € / kg. The weak dollar supports the booming export and slows down the price drop for the time being. The slaughter weights remain below 93 kg during the high summer temperatures.China's pig pens With 2.35 € / kg have on 26.07. Somewhat yielded. According to the latest statistics, the number of pigs in the first half of 2017 should have risen by 0.4%. Chinese consumers consume significantly less pork. Despite a 35% drop in prices and 6.5% income growth, the pork consumption remains below the average of previous years. The Chinese pork imports continue to decline. The Russian pork prices are on 19.07.In 2017 to € 2.31 per kg . A slightly stronger ruble contributes to the increase. The Russian pigmeat market is still deficit despite strong growth in its own production. Brazil is the main supplier. Nevertheless, large Russian meat conglomerates are targeting exports abroad. Brazilian pork prices are based on the average values in the southwest region on 02.08. To € 1.40 / kg. Rising domestic rates and a stronger real have contributed to the result. Brazil is benefiting from the Russian business.

ZMP Live Expert Opinion

In the middle of the holiday season the sales of pork in the north are only very modest. The below average living space is just needed. In the southern holiday countries, the seasonal peak prices are reached. Italy still has room to move up, Spain no longer. For the time being, no fundamental changes in supply-demand ratios are apparent.