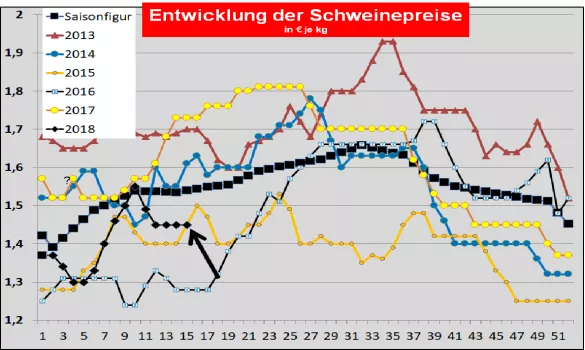

Pig prices for 14./15. KW-2018 The ISN Internet auction on 03.Apr.-18 delivered an average price of 1.51 € / kg in a range of 1.46 to 1.52 € / kg and a projection of 9%. General Market and Price Development: The pork market in Germany has weathered the difficult days before and after Easter relatively well. Due to public holidays, the battle numbers remained significantly lower.The pre-registration figures point to pent-up demand. Developments in the other EU Member States are mixed: declining prices in Italy and France, unchanged in other regions. In the international pig market, China's announcement of import duties on US pork has led to a strengthening of price reductions. Denmark: Danish pork prices have been reduced to 13 and 14 KW.-18 at reduced levels. For the upcoming 15. KW base prices will remain unchanged . In France / Brittany , the listing was on 29.03. reduced by -0.4 ct / kg.The battle numbers are with 377,822 (last week 379,248 before last week 379,953) piece in the upper average range. The Dutch slaughterhouses paid between 0-3 ct / kg in the 14th KW-18 . That should also apply to the 15th KW. Belgium: Pig prices remained unchanged in the 14th KW-18. Germany : For the 14./15.KW-18, the merger price was fixed unchanged at € 1.45 per kg or index point . The range is from 1.45 to 1.45 € / kg. The pre-registrations fall with 230,700 (previous week 215,500 before last week 235,700) piece again higher. Slaughter numbers of the past week are low with 861,945 (last week 1,036,655 last week 1,027,500) pieces due to the holiday. The applicable in Austria fattening pig base price for the 14./15. KW-18 remain unchanged. The pork prices in Spain are on Thu, 29.03. remained unchanged.In (Upper) Italy pig prices on 03.04 in Modena have been reset by -4 cents / kg , on Tues in Reggio -3 cents / kg and Cremona -4 cents / kg . The battle figures are at 45,222 (previous week 43,666 before last week 42,265) piece on a high level. In Poland on 23/03/2018 pork prices at 57% MFL fell to the equivalent of € 1,397 / kg . Outlook: The pork market is impressed by international developments in the post-week week. At the international level, there is a continuing decline in pig prices in almost all major production areas. The trade tensions between China and the US are exacerbating the price declines. The US prices are on 03.04.18. in IOWA fell to the equivalent of 0.823 € / kg . An increasing US domestic supply is putting pressure on prices for filled cold stores and impending tariffs on US pork deliveries. The stock market quotations in Chicago have fallen to 0.95 ct / kg for the front month April 2018.The barbecue months June / July / August should bring in the top only 1.31 € / kg. Pork prices in the US are expected to be around € 1 / kg and below for the supply-rich autumn / winter period. China's pig prices on 21.03.2018 have fallen to the equivalent of € 1.98 / kg . The increased supply from the newly built production facilities is only being taken up by declining demand for the New Year's Festival week in February at falling prices. There are fears that the high EU export figures to China may be significantly lower. On the other hand, pork imports are still cheaper than domestic production. The currently uneconomically low price level will lead to further operating tasks of the traditionally small units.Russian pork prices rose to € 1.98 / kg on 28.03.2018 . The supply quantities are smaller than expected just before the Easter holidays. Whether the new price level can be maintained, has yet to turn out. Brazilian pork prices have yielded on 04.03.2018 on average in the southwest region to the equivalent of 0.98 € / kg . The Brazilian Real has lost some of its purchasing power.The international competition from the USA and Canada is putting massive pressure on Brazilian export prices.

ZMP Live Expert Opinion

Pork quotations in the EU are increasingly falling into the waters of fallen international pork prices. Here the export dependency affects clearly. The stable prices in Germany are accompanied by house prices. The Chinese import tariffs for US pork are still a serious threat, but they are already having an impact. It remains an open question whether the EU will benefit from duty-reduced US shipments to China. China does not currently depend on high import volumes because its own production is increasing.