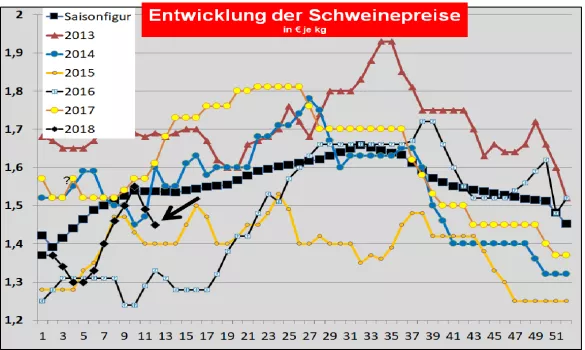

Pig prices for 11./12. KW-2018 The ISN Internet auction on 13-Mar-18 delivered an average price of € 1.50 / kg in a range of € 1.50 to € 1.525 / kg and a projection of 21.5%. General market and price developments: Despite lower battle numbers but increasing advance bookings, pig prices have been significantly reduced, especially in Germany, due to the previous strong price increase.In meat sales, the rising purchase prices could not be fully implemented. In the international pig market USA, Brazil, Russia, China, pig prices are all on the decline. In France, Spain and Italy, the markets are largely balanced, so that even small increases in price are possible Denmark: Danish pig prices were maintained unchanged for the 11. KW.-18 . For the upcoming 12 KW , the base prices will remain unchanged . , In France / Brittany , the listing was on 15.03.keep unchanged . The battle numbers are with 376,938 (last week 372,818 before last week 375,991) piece in the average range. The Dutch slaughter companies paid less by -2 ct / kg in the 11th KW-18 . Belgium: Pig prices were reduced by -5 ct / kg in the 11th KW-18 . Germany : For the 11./12.For KW-18, the merger price was reset to € 1.45 per kg or index point (-4 ct / kg) . The range is from 1.45 to 1.47 € / kg. The pre-registrations fall with 235,400 (previous week 227,100 before last week 212,000) piece higher again and let battle numbers above the 1 million piece mark expect. Battle numbers of the past week are with 980,782 (last week 949,114 before last week 938,916) piece for the 6th time under the 1 million mark mark in the New Year. The applicable in Austria fattening pig base price is for the 11/12. KW-18 can be reduced by -4 ct / kg. The pig prices in Spain were on Thu, 08.03.increased by an additional +1 ct / kg. In (upper) Italy pig prices are on 12/03 in order Modena + 0.3 ct / kg, di Reggio +0.1 ct / kg and Cremona +2.0 ct / kg enhanced. The battle figures lie with 42,764 (last week 41,798 before last week 42,754) piece in the tight midfield. In Poland , pork prices at 57% MFL of the equivalent of € 1.47 / kg were again higher on 02.03.2018. Outlook: Low battle numbers alone are not enough to maintain or increase prices. The meat sales have to go along with rising cost prices. At present, this succeeds only to an insufficient extent. In the other EU Member States developments are partly in contrast to German listing. International pork prices in third countries have fallen substantially almost everywhere. The US prices are on 14.03.18. in IOWA fell to the equivalent of € 1.06 / kg . The pork quantities can not be accommodated without problems in the market. The meat trade can realize its margins only limited. The dollar has given way again.Stock prices in Chicago have fallen for the front month April 2018 at 1.20. Only the barbecue months June / July / August should bring in the top € 1.40 / kg. In autumn 2018, only 1.15 € / kg is expected. China's pig prices on 07.03.2018 have fallen to the equivalent of € 2.15 / kg . The demand-intensive New Year's Week in mid-February has been able to compensate for the increased supply volumes from the newly built production facilities. Now the high supply pressure is fully impacting prices. There are fears that the previously expected high EU export figures to China may be significantly lower. On the other hand, the currently uneconomically low price level will lead to further operating tasks of the traditionally small units.The Russian pig prices fell back on 14.03.2018 to 1.57 € / kg . The supply pressure of growing production is no longer so quickly absorbed. Demand remains subdued for the time being. With rising feed costs, the calculation for Russian pigmeat is again somewhat narrower. Russian poultry producers are also having financial difficulties. On 13/03/2018, Brazilian pork prices on average in the south-west region fell again to € 1.06 / kg . The Brazilian Real has fallen in purchasing power again something.The international competition from the USA and Canada is putting massive pressure on Brazilian export prices.

ZMP Live Expert Opinion

The massive price decline in the German pork market represents a correction of the rapid previous increase in prices, which could not be passed on to a sufficient extent, inter alia, due to supply contracts for resale. Despite Easter business and increasing stocking for the barbecue season, the price level was not accepted by the demand side. The recent pre-registrations in Germany again point to currently higher battle numbers of more than 1 million pieces. Pigmeat markets are more balanced in some large EU Member States, such as France, Spain and Italy. However, the international pork prices are all on the verge of collapsing, so that the export business is under pressure from the competition.