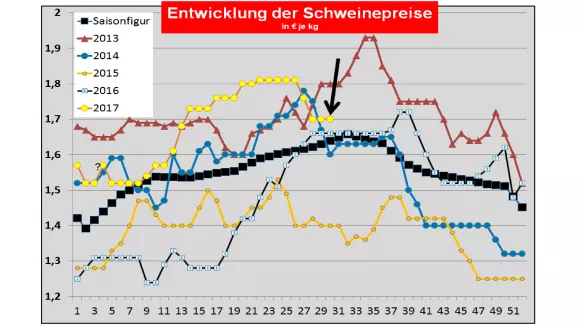

Pig prices for 30./31. KW-2017 The ISN Internet website on July 25, 2017 provided an average profit of 1.75 € / kg for a range of 1.73 -1.76 € / kg. The offer was 2,985 pigs. It remained supernate of 29.8%. General market and price trends: The tough sales business, in particular with valuable parts and processed goods, continues to be on a holiday-related basis. On the other hand, grillware runs quite well. The slaughter numbers and the battle weights remain below average.In Spain, the pork offer is sufficient for the holiday season, the high price level reached (1.91 € / kg) leaves no longer a lot of price margin up. In Italy leads The traveler's demand for greater sales opportunities to still rising prices. Austria also benefits from the holiday season. In France, the supply-demand ratio is balanced. In the US, pork prices have exceeded their summer peak and are sinking. Brazilian pig prices have continued to recover at a low level. Prices in China are on the order of magnitude 2,40 € / kg. China's pork imports continue to decline.Chinese consumers consume less pork in the context of a "health-oriented diet". Denmark: Danish pork prices were in the 30th . KW-17 maintained unchanged The slaughter numbers are -7.1% below the previous year's level. For the coming 31st KW-2017 , the prices will remain unchanged.In France / Brittany was The quotation (27.07.) Remains unchanged . The reported slaughter figures for the whole of France are included 354,469 (previous week 304,935 last week 353,054 358,784) pieces continue in the lower midfield.The Dutch slaughtering companies paid unchanged in the 30th KW . In the 31st KW 2017. , , , , Ct / kg can be paid.(Addendum follows) Belgium: Pig prices were maintained unchanged in the 30th week . The quotations of the slaughter companies are for the 31st KW 2017 ....... Ct / kg.(Supplement follows) Germany : The slaughter figures reach 958,853 pieces (previous week 958,309 last week 949,011). For the coming period from Thursday 27.07. Until Wednesday 02.08. (30th / 31st KW-17) , the association price was maintained at € 1.70 per kg or index point .The range ranges from 1.68 to 1.70 € / kg. The announced delivery volumes of the coming week are slightly higher with 216,500 (previous week 212,000 preceding week 215,684). The fattening pig's basic price, which was valid in Austria, KW remained unchanged. The pig offer falls Measured in terms of holiday-related extra mile. For the 30./31. KW should be retained. The pork prices in Spain were on Thurs, 20.07. Remain unchanged. In (Upper) Italy are pig prices on 24.07.In Modena at +2.3 ct / kg , at Di in Reggio +2.5 ct / kg and Cremona increased again by +3,0 ct / kg . The slaughter figures are included (Previous week 40,668 previous week 39.207) pieces in the bottom Midfield. In Poland , pork prices at 57% MFL of 1.70 € / kg were recorded on 14.07.2017 . Outlook: The demand for meat in the northern regions of Europe remains low due to the holiday / holiday season. In the southern holiday countries, demand remains buoyant.Pre-registrations in this area point to below-average Slaughter numbers for the current week. The US prices are on 24.07. on 1.57 € / kg has fallen.The stock exchanges in Chicago for later delivery dates in late summer and autumn Indicate a strongly downward tendency. In the autumn months prices between 1.25 and 1.35 € / kg are expected. The weak dollar supports the booming export. At the high summer temperatures, the slaughter weights are below 93 kg.China's pig sires have caught in the month of July at 2.40 € / kg for the time being. Increasingly It turns out that the Chinese consumers consume less pork, and for this they increasingly rely on vegetable side dishes. Despite steeply falling prices and 6.5% income growth, the pork consumption remains below the average of previous years. The Russian pork prices are on 19.07.In 2017 to € 2.31 per kg . A slightly stronger ruble contributes to the increase. The Russian pigmeat market is still deficit despite strong growth in its own production. Brazil is the main supplier. Brazilian pig prices are based on the average values in the Southwest Region at 18:07. To € 1.35 per kg. Rising domestic rates and a stronger real have contributed to the result. Brazil is benefiting from the Russian business.

ZMP Live Expert Opinion

Below-average slaughter figures and slaughter weights ensure that prices remain stable in the north of Europe, despite the fact that demand is weak. In the holiday centers the courses strive for their summery highs. In Spain the high point seems to have already been reached. If there is little change in the supply potential, the prices should remain stable.