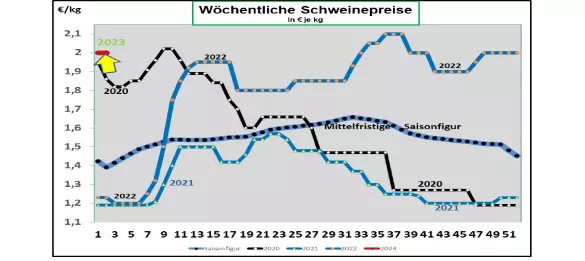

Germany: V price 2.00 €/kg (range 2.00 – 2.00 €/kg) - the weekly slaughter figures are smaller with 650,106 pigs without East Germany ( previous week 808,947 ); the slaughter weights have increased slightly to 96.9 kg . With 339,200 pigs (previous week 239,500 ), the pre- registrations indicate a need to catch up.When reselling the cuts to food retailers, processors and for export, the average prices have repeatedly remained at €2.35/kg . At the ISN auction on Tue, Jan 03. In 2023 , an average price of €2.09/kg (unchanged from the pre-auction) was achieved in a range of €2.075 to €2.105/kg. The supernatant was 66% . The V price for the period from January 5th, 2023 to January 11th, 2023 has remained at €2.00/kg; the range is from 2.00 to 2.00 €/kg. ASF : As of December 30, 2022, 4,722 ASF infected wild boars in Brandenburg, Saxony and Mecklenburg have been officially confirmed. Recently, a strong accumulation of finds in the Spree-Neisse area (Brandenburg) was observed. Market and price development in selected competitor countries: In Denmark , prices in the 01.KW 2023 was reduced by 5 ct/kg at a comparable calculated €1.83/kg. In Belgium , the prices in the 01st week of 2023 remained unchanged at €1.92/kg. In the Netherlands , the prices in the 01st week of 2023 with a comparably calculated €1.82/kg fell by around 5 ct/kg. In France/Brittany , prices rose by +1 ct/kg to €1.83/ kg . The slaughter figures are little changed at 373,654 pigs. Slaughter weights are slightly lower at just under 96 kg. In Italy , the prices in the 01st week of 2023 fell by a further 2.0 €/kg . The holiday business has ended. In Spain , the prices in the 01st week of 2023 remained at a comparable €2.16/ kg. The domestic supply of live animals only just covers demand.In the USA/IOWA , prices have fallen further to the equivalent of € 1.57 /kg . The sales business was significantly restricted by the cold snap, the prices for fresh cuts could still increase; Processing goods gave way significantly. For the new front month February-2023, the futures prices on the stock exchange are again at €1.85/kg; Ascending trend. Brazil: Producer prices have increased to €1.72/kg on average with weaker REAL. Domestic demand remains high, but export business has slowed noticeably. China: Prices have fallen significantly to the equivalent of € 3.41/kg . The exchange rate has stabilized somewhat. The usual boost in demand before the Chinese New Year at the end of January 2023 has had almost no effect. The forward rates for the month of Jan.-2023 are only traded at €2.58/kg.Prices above €3.12/kg will not be traded again until May 2023. Conclusion: The usual slump in sales in the meat business after the holidays has not yet been overcome. The search for orientation for further market and price developments is still ongoing. The livestock trade is quite balanced after the holidays.

ZMP Live Expert Opinion

After the holidays, the livestock trade is mostly balanced compared to previous years; large overhangs were not observed. However, meat sales are developing only slowly. This year the need for replenishment is low. A clear direction of development is not yet discernible for the coming weeks. Different supply situations prevail in the EU internal market.