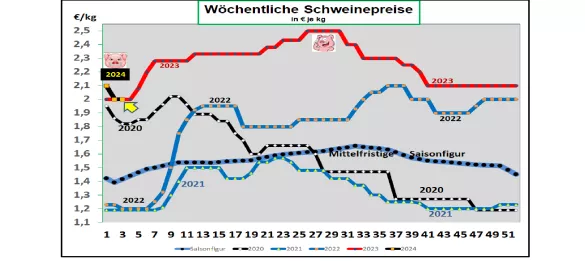

Germany: V- price 2.00 €/ kg (range 2.00 – 2.05 €/kg) The weekly slaughter numbers have increased again to an average weekly level of around 750,000 pigs ( previous week 694,638 ), and the slaughter weights have fallen to 98 kg . Pre-registrations have fallen to 266,900 pigs (previous week 279,300) . The ISN auction on Tuesday, January 23rd.2024 brought an average of €2.09/kg in a range of €2.075 – €2.095/kg. The V-Prize is for the period from January 25th, 2024 to January 31st. 2024 has been set at 2.00 €/kg in a range of 2.00 - 2.05 €/kg. ASF : As of January 22, 2023, 5,625 ASF-infected wild boars have been officially confirmed in Brandenburg, Saxony and Mecklenburg. In December 2023, 21 ASF cases were reported, 17 of which were in Brandenburg. Market and price developments in selected competitor countries: In Denmark, the comparable calculated prices in the 4th week of 2024 were a further -5 ct /kg at 1.74 € /kg. kg has been reduced. Since the beginning of the year, the price reduction has totaled -17 ct/kg. In Belgium the prices are in the 04.Week 2024 with comparable calculated prices of 2.01 €/kg was reduced by -5 ct/kg. In the Netherlands, the quotations will be reduced by a further -5 ct/kg in the 4th week of 2024 with comparable prices of €1.90/kg . Since the beginning of the year the price has fallen by -15 ct/kg. In France/Brittany prices remained unchanged at €1,782/kg . The number of pigs slaughtered has fallen again to 361,928 pigs with a slightly reduced slaughter weight of 97.05 kg. In Italy, the prices were reduced by a further -2 ct/kg in the 4th week of 2024. The trigger is a subdued demand with a slightly increasing supply. In Spain, prices will remain unchanged in the 4th week of 2024 at a comparable €2.14/ kg, despite increasing supply again. In the USA/IOWA, producer prices have initially stabilized after the holidays at €0.93/kg .Slaughter numbers have increased again, but demand remains very subdued. The section prices stabilize at a reduced level. For the front month of February-24, however, the stock market prices are already back at €1.43/kg. After months of losses, US farmers are expecting more profitability again. Brazil: Producer prices have fallen on average to €1.51/kg . Demand remains weak after the holidays. Exports can still provide little impetus for the time being. However, increases in production and exports are expected for 2024. China: Prices have fallen further to €2.51/kg . Given the unusually weak demand ahead of the upcoming Chinese New Year (Feb. 10, 24), the high supply remains a strong pressure on prices. For the month of May-2024, 2.55 €/kg is traded on the Dalian Stock Exchange. A reduced pig market of around -3% is expected for 2024.Conclusion: Pig prices have fallen significantly in important northern European countries. After the holidays, increasing live supplies and the typically weak demand lead to price pressure. Fewer slaughter capacities also have an effect.

ZMP Live Expert Opinion

The increasing live supply after the holidays is met by the seasonally weak demand in the month of January. Added to this is the reduction in slaughtering capacity. Pig prices in northern European export countries have fallen even more sharply than in Germany. This limits the price scope considerably.