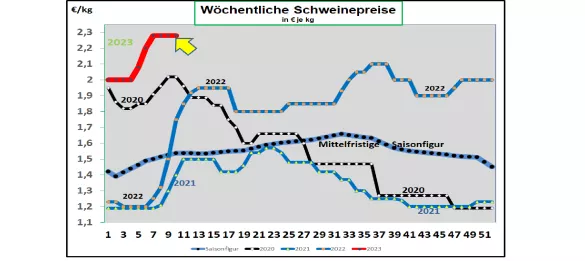

Germany: V price 2.28 €/kg (range 2.28 – 2.33 €/kg) - unchanged The weekly slaughter figures have risen to 746,679 pigs ( previous week 726,826 ), but remain well below the multi-year average values; the slaughter weights have decreased somewhat to 97.2 kg . With 238,000 pigs (previous week 227,400 ), the pre-registrations remain well below the average of previous years. Price quotation for cuts has been discontinued. At the ISN auction on Tue, 07.An average price of €2.36/kg was achieved in a range of €2.35 to €2.38/kg in March 2023. The V price for the period from 03/09/2023 to 03/15/2023 remained at €2.28/kg; the range is from 2.28 to 2.33 €/kg. ASF : As of March 2nd, 2023, 5,128 ASF infected wild boars in Brandenburg, Saxony and Mecklenburg have been officially confirmed. In the month of Jan.23 alone, 216 cases were reported. Domestic pigs in a small herd of 11 animals in the Neisse-Spreen area were culled. Market and price development in selected competitor countries: In Denmark, the prices in the 10th week of 2023 have remained unchanged at a comparable calculated €1.80/kg . The high Danish export dependency to third countries limits the price scope. In Belgium, prices are in the 10thCW 2023 remained unchanged once again at €2.16/kg . Pigs are scarce, but meat sales are limited. In the Netherlands , the prices in the 10th week of 2023 also remained at a comparable calculated €2.16/kg . Higher rates are not accepted on the sell side. In France/Brittany, prices have again been increased by the weekly maximum of +6 ct/kg to €2.316/kg . The slaughter figures are as low as 356,000 pigs. Slaughter weights have increased slightly at 95.87 kg. In Italy, the listings in the 10th week of 2023 rose again by a further 4 ct/kg . The supply remains too small for the demand. In Spain, the prices in the 10th week of 2023 were increased again by 6 ct/kg at a comparable €2.52/ kg. Slaughter pigs from Germany and abroad are sought to utilize the slaughter capacities.The Pig Association fears that ASF will be introduced as a result of the large number of piglet imports. In the USA/IOWA, prices have stabilized at the equivalent of €1.62/kg . Battle numbers remain at reduced levels. However, the part prices support the listing level. For the front month Apr-2023, the futures prices on the stock exchange are €1.87/kg; for the summer months prices of over 2 €/kg are already being traded. Brazil: The average producer prices have been reduced to 1.80 €/kg with REAL becoming stronger again. The carnival effect is over. Nevertheless, the price level remains above average due to the cost-related reduced pig stock in the non-contractual farms. China: Prices rose slightly in mid-February 2023 week to the equivalent of €2.75/kg . The demand for meat is seasonally weak. But the state is conducting stock purchases to stabilize.May 2023 rates of the equivalent of €3.06/kg are already being traded on the Dalian Stock Exchange. For the July 2023 delivery, prices are back at €3.20/kg. The exchange rate has strengthened. Conclusion: The persistently low slaughter figures lead to a significant decline in the meat supply. But the demand for meat is still so restrained that further price increases can hardly be pushed through. The market needs a certain amount of time to reorient itself to the increased price level. In any case, the hopes for a fundamental price reduction are hardly justifiable. Livestock numbers across the EU tend to point to a further shortage of legends on offer.

ZMP Live Expert Opinion

Even though the number of slaughtered animals has risen from the low values of the previous weeks, the supply situation for live animals remains scarce. In the case of meat sales, the restrained demand is slowing down due to the increased prices. A fundamental increase in supply is not to be expected according to the most recent evaluation of the EU livestock census results. In particular, the sow stocks were significantly reduced. As a result, there will be a lack of offspring for the foreseeable future.