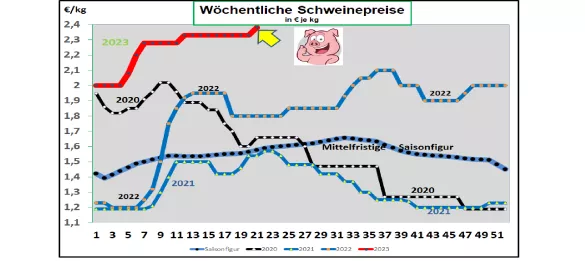

Germany: V price 2.33 €/kg (range 2.33 – 2.38 €/kg) The weekly slaughter figures are below average with 639,356 pigs ( previous week 744,006 ) due to public holidays, the slaughter weights are also 97.2 kg remain below the average of previous years with 241,600 pigs (previous week 245,650) . At the ISN auction on Tue, May 23rd.In 2023, an average price of €2.45/kg or +0 ct/kg was achieved at the pre-auction in a range of €2.42 to €2.465/kg. The V price has been retained at €2.33/kg for the period from May 25, 2023 to May 31, 2023 within a range of €2.33 to €2.38/kg. ASP : As of May 19th. In 2023, 5,339 wild boar infected with ASF were officially confirmed in Brandenburg, Saxony and Mecklenburg. In Romania, a farm with 18,000 pigs was culled. In Calabria (Italy), 800 km from the nearest ASF area, 70 domestic pigs were infected. South Korea's ASP ban on Germany has been lifted. Market and price development in selected competitor countries: In Denmark, the comparably calculated prices of €2.04/kg were repeatedly retained unchanged in the 21st week of 2023. In Belgium, prices will be announced in the 21stKW 2023 with 2.21 €/kg remained unchanged for several weeks. Despite the limited live supply, meat sales remain difficult. In the Netherlands , the prices in the 21st week of 2023 have again remained unchanged with a comparable calculation of €2.22/kg . In France/Brittany, prices remained constant again for the first time at €2.153/kg . Due to the holiday, battle numbers remain low at 316,817; the slaughter weight is 96.7 kg. In Italy , the listings in the 21st week of 2023 have been reset by a further 4 ct/kg . The demand from the slaughterhouses continues to fall. In Spain, the prices in the 21st week of 2023 remained unchanged at a comparable €2.64/ kg for the umpteenth time. Although the slaughtering capacities are not fully utilized, the high price level is slowing down sales opportunities at home and abroad.In the USA/IOWA, prices suddenly rose to €1.80/kg . A court ruling in favor of more animal welfare has unsettled the marketing industry. In the other listing areas, the equivalent of €1.73/kg is traded. Stock market prices for Aug-23 have fallen to €1.76/kg, falling well short of previous expectations. Brazil: Producer prices have fallen to €1.58/kg on average with stronger REAL. The price ranges between the south-east surplus area and northern high-price regions are tightening. Production and export continued to increase in the first quarter of 2023. China: Prices remain stable at the beginning of May 2023 at the equivalent of €2.54/kg . The demand for meat is seasonally weak. On the Dalian Stock Exchange, the equivalent of €2.95/kg is being traded. In the face of sustained losses, government stockpiling has resumed. Conclusion: slaughter days that are canceled due to public holidays slow down demand in the livestock business.Expectations of an increasing demand for meat have not been fulfilled so far. Hopes are pinned on favorable barbecue weather.

ZMP Live Expert Opinion

. The persistently low slaughter figures are offset by the hesitant demand. Stagnating price developments also prevail in the neighboring countries. Nevertheless, there is still hope for price improvements as a result of the continued low supply of live food and low cold store stocks once the demand for grills really picks up.