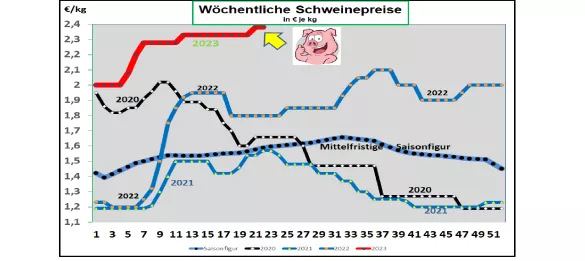

Germany: V price 2.38 €/kg (range 2.38 – 2.43 €/kg) The weekly slaughter figures are below average with 676,161 pigs ( previous week 639,356 due to public holidays), the slaughter weights are also lower at 97.3 kg . With 246,600 pigs (previous week 241,600), the pre-registrations remain at a comparatively reduced level. At the ISN auction on Tue, May 30th.In 2023, an average price of €2.52/kg or +0 ct/kg was achieved at the pre-auction in a range of €2.51 to €2.535/kg. The V price has been set at €2.38/kg for the period from June 1st, 2023 to June 7th, 2023 within a range of €2.38 to €2.43/kg. ASP : As of May 26th. In 2023, 5,359 wild boar infected with ASF were officially confirmed in Brandenburg, Saxony and Mecklenburg. South Korea's ASP ban on Germany has been lifted. Market and price development in selected competitor countries: In Denmark, the comparably calculated prices of €2.04/kg were repeatedly retained unchanged in the 22nd week of 2023. In Belgium, the prices will be raised by 5 ct/kg in the 22nd week of 2023 at €2.25/kg . The Belgian quotation is thus in line with the results in the neighboring countries.In the Netherlands, the prices in the 22nd week of 2023 have been increased by 5 ct/ kg with a comparable calculation of €2.27/ kg. In France/Brittany, prices remain constant at €2.153/kg . Due to pent-up demand, the slaughter figures have risen to 374,000; the S97.3 kg carcass weight at 97.3 kg In Italy , the listings in the 22nd week of 2023 have been reset by a further 3 ct/kg . Since the end of April, prices have fallen by a total of 15 ct/kg. Limited hopes are pinned on the holiday season. In Spain, the prices in the 22nd week of 2023 remained unchanged at a comparable €2.64/ kg for the umpteenth time. The high price level slows down meat sales opportunities at home and abroad. Slaughter pigs are z. T introduced. In the USA/IOWA, prices have fallen back to €1.72/kg .A California court ruling calls for more animal welfare for the 85% imports from other states. In the other listing areas, the equivalent of €1.55/kg is traded on average. Stock market prices for Aug-23 have fallen to €1.62/kg - well below previous prices of around €2/kg. Brazil: Producer prices have fallen to €1.44/kg on average. Failed slaughter days have led to a supply backlog. The price ranges between the south-eastern surplus area and northern high-price regions have narrowed even further. After higher production and export figures in the first quarter of 2023, business weakened seasonally. China: Prices remain low at the equivalent of €2.56/kg in mid-May 2023. The demand for meat is seasonally weak. On the Dalian Stock Exchange, September 23 prices are traded at the equivalent of €2.91/kg.In view of the continuing losses, government stock purchases are again Conclusion: In the EU internal market, prices in the northern production areas are starting to move after a long period of stagnation. Increasing demand for meat due to the weather and a limited supply open up price scope upwards.

ZMP Live Expert Opinion

After weeks of stagnation in listings, more lively demand due to the weather is leading to the first price increases. The live supply and the cold store stocks are limited. The tight supply situation could worsen in the coming weeks.