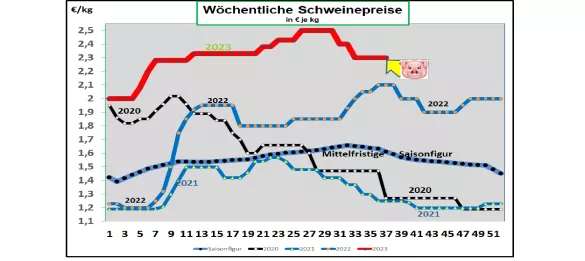

Germany: V- price 2.30 €/ kg (range 2.25 – 2.30 €/kg) The weekly slaughter numbers were higher again at 717,612 pigs ( previous week 703,921) , but the slaughter weights fell to 97.4 kg . Pre-registrations remained at a comparatively high level at 267,900 pigs (previous week 270,200) . At the ISN auction on Tue. 12.09 2023 an average price of 2.32 €/kg . achieved in a range of 2.31 – 2.33 €/kg. The overhang continued to be large. The V price has been set at €2.30/kg in a range of €2.25 - €2.30/kg for the period from September 14th, 2023 to September 20th, 2023. ASF : As of September 8, 2023, 5,555 ASF-infected wild boars have been officially confirmed in Brandenburg, Saxony and Mecklenburg. In August 23 alone, 58 cases were confirmed in Brandenburg and Dresden. The first case has occurred in Sweden. Market and price development in selected competing countries: In Denmark , the comparable prices were reduced by -6 cents /kg to €1.91/kg in the 37th week of 2023. In Belgium the prices are in the 37th.Week 2023 remained unchanged with comparable calculated prices of €2.19/kg . In the Netherlands , prices will remain unchanged in the 37th week of 2023 at a comparable €2.17/kg . In France/Brittany prices remain unchanged at €2.046/kg . The number of battles rose to 261,832; Slaughter weights are a reduced 95.34 kg. In Italy , the prices increased slightly again in the 37th week of 2023 by +0.5 ct/kg. Supply remains tight. The demand effect of the holiday season is still ongoing. In Spain, prices will be reduced by a further -3 ct/kg in the 37th week of 2023 to a comparable €2.46/ kg. Declining meat sales are forcing prices to be adjusted downwards. In the USA/IOWA, producer prices have initially stabilized at €1.64/kg. The number of battles remains at a high level. The unit prices have recovered again. For Oct.-23 the stock market prices are only at 1.68 €/kg. Brazil: Producer prices have increased again on average to €1.61/kg . Domestic demand has picked up somewhat again after the weak summer months. However, the live supply remains limited depending on the season. Export figures have picked up speed again. China: Prices have risen further to €2.95/kg. The increased government purchases of stocks have caused prices to rise. Only for the consumption-intensive month of January 2024 is €2.96/kg expected again. However, the spring months of 2024 show weaker trends again. Conclusion: The slaughter numbers remain at a reduced level at less than 720,000 per week. Pre-registrations have tended to increase. The limited supply of meat continues to meet with subdued demand. The lower market range was raised again. In the European environment, market and price developments are visibly stabilizing.

ZMP Live Expert Opinion

Despite reserved demand for meat in the holiday off-season and the grilling phase coming to an end, the limited supply ensures prices remain high. More stimulus could come from the processing industry after the company holidays. In the European environment, market and price conditions are stabilizing.