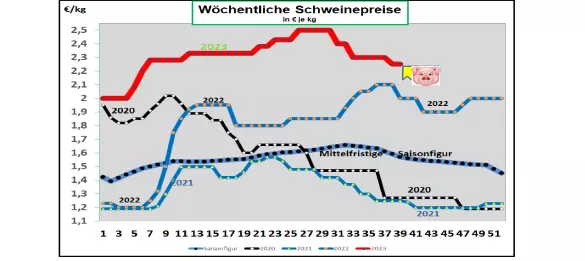

Germany: V- price 2.25 €/ kg (range 2.25 – 2.25 €/kg) The weekly slaughter numbers were higher again at 729,433 pigs ( previous week 723,913) , and the slaughter weights increased only slightly at 97.5 kg . Pre-registrations remained at a comparatively high level at 264,200 pigs (previous week 267,300) . At the ISN auction on Tue. 26.09 2023, due to a lack of demand, no auction took place for the 2nd time in a row . The V price for the period from September 28th, 2023 to October 4th, 2023 is 2.25 €/kg in a range of 2.25 - 2.25 €/ kg has been set. ASF : As of September 22, 2023, 5,566 ASF-infected wild boars have been officially confirmed in Brandenburg, Saxony and Mecklenburg. In Sweden, the number of ASF wild boar finds has increased to over 40. More than 30,000 domestic pigs have now been culled in northern Italy. Market and price development in selected competing countries: In Denmark , the comparable prices were reduced by -3 ct /kg to €1.86 /kg in the 39th week of 2023. In Belgium, prices remained unchanged in the 39th week of 2023 with comparable prices of €2.19/kg .In the Netherlands, prices will be reduced by -2 cents /kg in the 39th week of 2023 with a comparable calculation of €2.15/kg . In France/Brittany prices fell by -2 cents /kg to €2.01/ kg . The number of battles fell to 350,163; Slaughter weights are a reduced 95.2 kg. In Italy, the prices were further increased by +2 ct/kg in the 39th week of 2023. Supply remains tight. The ASF culling is now causing noticeable bottlenecks. In Spain, prices will be reduced by a further -4 ct/kg in the 39th week of 2023 to a comparable €2.39/ kg. After the hot summer phase, slaughter weights increase. Declining meat sales are forcing prices to be adjusted downwards. In the USA/IOWA, producer prices have stabilized at €1.62/kg. The number of battles has decreased. The section prices have mostly been reset for seasonal reasons. For Oct.-23 the stock market prices are at 1.69 €/kg. Brazil: Average producer prices have been reset to €1.63/kg . Domestic demand drops noticeably towards the end of the month. However, the live supply remains limited depending on the season. The export figures are on a stable course. China: Prices have fallen again to €2.86/kg. Government stock purchases are suspended. Only for the consumption-intensive month of January 2024 is €2.96/kg expected again. However, the spring months of 2024 show weaker trends again. Conclusion: The current autumn period is usually characterized by a slightly increasing supply of pork with limited demand due to the phasing out of grilling activities. The number of battles stabilizes at over 720,000 per week. Pre-registrations also remain at an elevated level. Prices are coming under increasing pressure.

ZMP Live Expert Opinion

The autumn season, with a typically increasing supply and a simultaneous decline in demand for grills, puts prices under pressure. However, the supply level remains significantly below the average of previous years and the price level remains above the annual average.