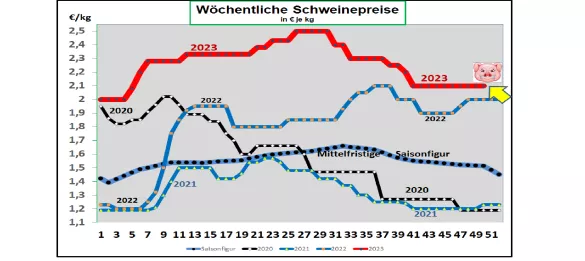

Germany: V- price 2.10 €/ kg (range 2.10 – 2.10 €/kg) The weekly slaughter numbers were slightly lower at 752,525 pigs ( previous week 755,318 ), and the slaughter weights fell to 97.2 kg . The pre-registrations have increased slightly with 255,700 pigs (previous week 255,600) . The ISN auction on Tuesday 12th.12 2023 brought a price of €2.24/kg on average for the animals sold. Range ranges from 2.23 -2.25 €/kg. The V price has been set at €2.10/kg in a range of €2.10 - €2.10/kg for the period from December 14, 2023 to December 21, 2023. ASF : As of December 7, 2023, 5,606 ASF-infected wild boars have been officially confirmed in Brandenburg, Saxony and Mecklenburg. In November 2023, 23 ASF cases were reported, mostly in Brandenburg. Market and price development in selected competitor countries: In Denmark, the comparable prices in the 50th week of 2023 remained unchanged at €1.91/kg . In Belgium, prices remained at a comparable price of €2.09/kg in the 50th week of 2023.In the Netherlands , the quotations in the 50th week of 2023 will remain unchanged with comparable prices of €2.05/kg . In France/Brittany prices rose by 1 ct/ kg to €1.781 /kg . The slaughter numbers reach a below-average 358,000 pigs with a slaughter weight of 96.06 kg. In Italy, the prices were reset by -2 ct/kg in the 50th week of 2023. Demand has decreased. In Spain, prices will remain unchanged at a comparable €2.14/ kg in the 50th week of 2023. Lower slaughter numbers are compensated for by higher slaughter weights. The export business has declined. In the USA/IOWA, producer prices fell again significantly to 1.02 €/kg; the price is only half as high as in July 2023. The slaughter numbers have fallen, but the slaughter weights have increased. Inventories are growing in the cold storage facilities.The unit prices have fallen significantly. For the new front month of February-24, the stock market prices are at 1.37 €/kg. For the month of April 2024, 1.70 €/kg is being traded. But we are currently in the red. Brazil: Producer prices have increased slightly on average to €1.68/kg . Domestic demand shows a seasonal upswing. However, exports have declined. China: Prices have risen again to €2.61/kg . Support comes from government stock purchases. Demand remains below average. The January 2024 prices have increased to €2.52/kg. In the government's opinion, the pig population is still too high for profitable prices, and the sow population in particular should be reduced again. Conclusion: Pork prices will continue to remain at current levels despite brisk demand and limited supply. Hopefully keeping quiet over the holidays and beyond will be honored.

ZMP Live Expert Opinion

Pig prices are frozen if there is barely enough supply. Obviously they want to keep the price level reached over the holidays.