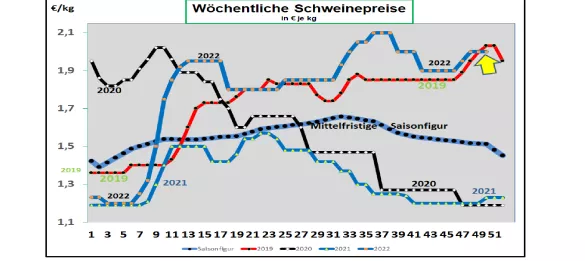

Germany: V price 2.00 €/kg (range 2.00 – 2.00 €/kg) - no range The weekly slaughter figures are higher at around 792,499 pigs ( previous week 772,366 ); However, the slaughter weights have decreased to 97.0 kg . Advance registrations remain repeatedly low at 252,700 hogs (previous week 252,400 ). When reselling the cuts to food retailers, processors and for export, the average prices remained unchanged at €2.35/kg . At the ISN auction on Tue, Dec 13In 2022, an average price of €2.08/kg (-5 ct/kg to the pre-auction) was achieved in a range of €2.08 to €2.08/kg. The V price for the period from December 15, 2022 to December 21, 2022 has remained at €2.00/kg; the range is from 2.00 to 2.00 €/kg. ASF : As of December 7th, 2022, 4,656 ASF infected wild boars in Brandenburg, Saxony and Mecklenburg have been officially confirmed. An end is not yet in sight. For the first time in 5 years, an ASF infected wild boar has been found in the Czech Republic. Market and price development in selected competitor countries: In Denmark , prices in the 50th week of 2022 have repeatedly stopped at a comparable calculated €1.88/kg. In Belgium , the prices in the 50th week of 2022 remained unchanged at €1.92/kg. The ongoing pre-Christmas business supports meat sales.In the Netherlands , the prices remain stable in the 50th week with a comparable calculated €1.88/kg. In France/Brittany , prices remain unchanged at €1.81/kg . The slaughter figures are little changed at 381,860 pigs. Slaughter weights are slightly lower at 96.3 kg. In Italy , the listings in the 50th week of 2022 remained unchanged at €2.01/kg . The high price level is dampening demand. In Spain , prices in the 50th week of 2022 have increased slightly to a comparable €2.16/ kg. The domestic supply of live animals is supplemented by imports of animals for slaughter. In the USA/IOWA , prices have fallen further to the equivalent of € 1.72 /kg . Although battle figures give way a bit, but the prices for parts had to be reduced again.The pre-Christmas business is decreasing. For the new front month February-2022, the futures prices on the stock exchange are listed at €1.75/kg; Ascending trend. Brazil: Producer prices have stabilized on average at €1.63/kg with REAL unchanged. The demand effect from the football World Cup and the pre-Christmas business is easing. China: Prices have fallen significantly to the equivalent of € 4.27/kg . The exchange rate has strengthened a little. The forward rates for the month of Jan.-2023 are only traded at €3.22/kg. After the Chinese New Year celebrations at the end of January 2023, prices should be around a little over 3 €/kg according to stock market prices, with increasing supply and seasonally declining demand. Conclusion: The declining pre-Christmas business is slowing down further price increases despite the moderate supply of living things. Prices should remain stable over the holidays.

ZMP Live Expert Opinion

The pre-Christmas mood of demand is easing. The part prices for resale to food retailers have not increased further. Although the number of slaughters has increased, the weights have fallen noticeably. It can be assumed that early games are behind it. The low pre-registrations continue to signal low battle numbers. The time between the years should hardly lead to sales difficulties for slaughter cattle, because there are only 2 slaughter days in total. However, a setback is to be expected for meat demand.