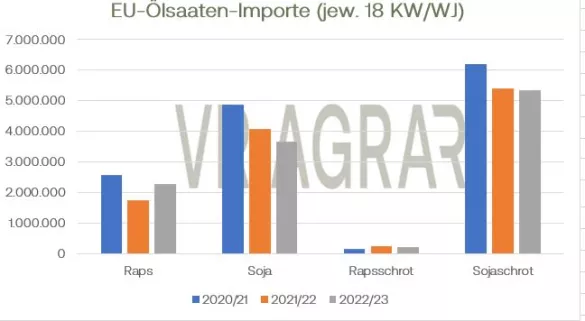

While soybeans were able to gain value on the CBoT over the course of the week, rapeseed prices are significantly weaker today than they were a week ago. The new front month of February 2023 ended trading yesterday with a closing price of EUR 637. Last Friday the contract was quoted at EUR 664.25/t. The cash market remains relatively calm. Farmers are not rushing to the market with their goods, oil mills and feed mixing plants are obviously sufficiently supplied by the end of the year and are therefore asking for few goods. EU imports remain at a high level. 2.28 million tons were imported by the end of October in the current marketing year. By the end of October 2021, however, it was only 1.7 million tons. The rapeseed market is being put under pressure primarily by an improved supply situation. This was also confirmed by the USDA on Wednesday in its November WASDE. Global rapeseed production will be increased by 1 million tons to 84 million tons due to better harvest results and harvest prospects in Europe and Australia. With the declining stock markets, the spot market prices for rapeseed also fell.Yesterday in Hamburg 637 euros/t were called for prompt lots, in Straubingen 632.00 euros/t and thus 15 euros/t less than a week before. With the start of trading today on the Euronext/Matif, the rapeseed prices are under pressure. The soy complex, on the other hand, has developed more firmly. The WASDE, published on Wednesday at 18.00 CET, supported the contracts on the CBoT and basically gave a little support to European rapeseed on that day. The US harvest was valued somewhat higher by the USDA, but lower quantities in Argentina are dampening the global supply situation, and global production figures have been reduced accordingly. The severe drought in Argentina is hampering sowing. According to the grain exchange in Buenos Aires, many farmers have not even started tilling the fields. The USDA reduced its soybean forecast for Argentina from 51 million tons to 49.5 million tons, but even this lower value seems to be at least questionable. According to official reports, the Argentine government is considering guaranteeing a better exchange rate for soybean exporters in the near future in order to boost exports and thus improve the country's foreign exchange reserves.Market participants are certainly concerned about the further development of export demand from China. There were rumors at the beginning of the week that the country wanted to deviate from the very strict corona policy. However, these rumors were immediately denied by Beijing. The US dollar weakened this week, also because better inflation data from the US eased fears of further high rate hikes. This improves the attractiveness of US beans a little, although yesterday's export figures disappointed the market overall.

ZMP Live Expert Opinion

Rapeseed and soya have recently moved differently. The better harvest prospects and thus the significantly better rapeseed supply situation is putting pressure on prices. The uncertainty regarding the continuation of Ukrainian agricultural exports via the Black Sea does little to change this. At the same time, the Ukraine conflict is causing uncertainty and persistently high price levels. The record harvest in Brazil on the one hand and the poor conditions in Argentina on the other promise volatile trading trends on the cash markets and on the CBoT in the coming weeks.