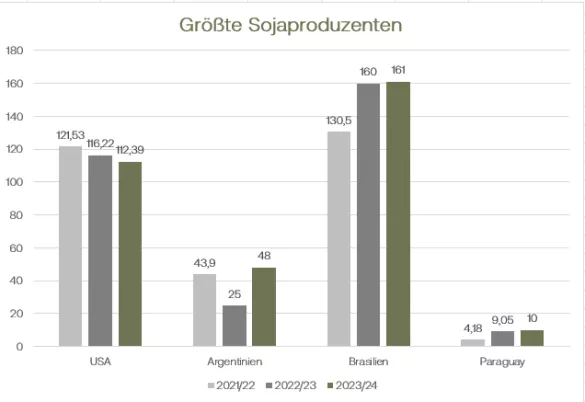

Over the past week, rapeseed prices have shown a stable side. On a weekly basis, there was only a marginal increase of 0.25 euros/t in the leading front month of February 2024. On Friday, this date closed at 441.50 euros/t. This Monday's trading session will continue with slight discounts until midday. Overall, the rapeseed market appears calm. Since the mills are well supplied until the end of the year, current sales remain manageable. Farmers are largely satisfied with the development of the plants for the next harvest. Europe's imports continue to be below the previous year's volume level, also due to the good last harvest. The EU Commission last issued a rapeseed forecast of 19.86 million tonnes at the end of November. As part of the WASDE report, the USDA continues to expect a European harvest of 20.1 million tonnes. Overall, the USDA has raised its forecast for global canola production. Instead of the 85.579 million tons issued in November, 86.979 million tons are now expected. However, the forecast is still below the harvest level of the previous year, when 88.815 million tonnes of rapeseed were harvested.The production forecasts for Canada and Australia in particular were increased. Consumption is estimated at 86.30 million tons, so there will probably not be a global rapeseed deficit this marketing year. In the soy market, the focus recently has been on the weather conditions in Brazil. Several private analysis houses recently reduced their forecasts for the country's soybean harvest this season. The USDA also took this step in its December WASDE, which was published on Friday. Instead of the previous 163 million tons, the ministry's experts now expect a Brazilian soybean harvest of 161 million tons, which is likely to be around one million tons more than last year's harvest. In general, global soy production is significantly above the previous year's quantitative level. The harvest is expected to be slightly lower compared to the November WASDE due to the Brazilian conditions, but at 398.88 million tons, the previous season's harvest result of 374.39 million tons is significantly exceeded. Global ending stocks are expected at 114.21 million tonnes compared to 101.92 million tonnes ending 2022/23.Overall, soy fell over the week, and soy meal and soy oil were also traded weaker in the past week. This is also reflected in the falling spot market prices for soybean meal on the local spot markets. Declining oil prices and better weather prospects in South America had weighed on the soy complex overall. Export news, some of which was very positive, was unable to sustainably move the market upwards.

ZMP Live Expert Opinion

The earnings outlook for South America has improved significantly, although many analysts including the USDA have revised down production forecasts. The global supply situation is more than ample thanks to growing production and rising final stocks, which is likely to put further pressure on price quotations. The rapeseed market, on the other hand, has been moving sideways for weeks due to the back and forth of news and influencing factors, without losing any of its volatility.