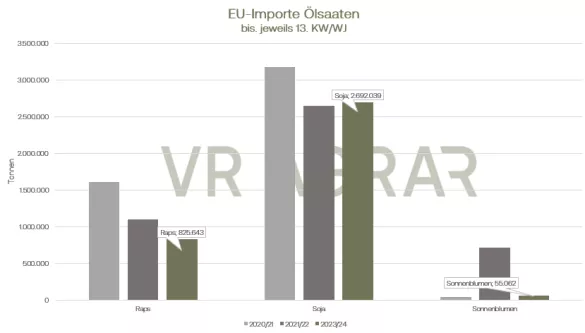

On a weekly basis, rapeseed increased. While last Friday there was a closing price of 441.25 euros/t on the display board on the Paris stock exchange, yesterday the November contract was 445.00 euros/t. As usual, oilseeds were volatile. On Wednesday, rapeseed rose by a significant 11.50 euros/t, particularly due to the rally in crude oil and jumps in the price of vegetable oils. Yesterday it went into correction mode again and recorded a daily loss of 7.25 euros/t. Europe continues to import less rapeseed than last year. Up to and including the 13th calendar week of the current marketing year, 925,643 tonnes of rapeseed were imported into the EU, compared to 1.4 million tonnes at this point in the previous year. As recently as before, the most important supplier is Ukraine. However, their ability to deliver is being questioned following recent attacks on the ports in Odessa and Ismail. Significantly fewer sunflowers were also imported into the EU. However, soy imports have increased slightly and more rapeseed meal has also been imported into the 27 member countries. The International Grain Council estimates the European harvest at 19 million tonnes, 500,000 tonnes less than last year.For Australia and Canada, the production forecasts for 2023/24 have also been reduced and with a global harvest of 86 million tonnes, less rapeseed will be taken from the fields than in the previous year. Instead of a surplus of 3.7 million tonnes in the last marketing year, the International Grain Council expects a production deficit of 2.1 million tonnes, as demand is also estimated to be higher. Canada's farmers are still busy with the harvest. In the more northern areas of the prairie, rainfall has recently slowed down the harvest, but in the more southerly growing areas, work can continue at temperatures of around 20 degrees. On the cash markets, rapeseed trading remains calm overall. Demand for rapeseed meal had recently decreased. Soybeans on the CBoT gained over the week. The beans particularly benefited from the crude oil rally on Wednesday. In addition, market participants expect cuts in today's quarterly reports on ending stocks compared to WASDE. The estimates assume that these will be around 6 million bushels lower than was assumed in the September WASDE. Meanwhile, US farmers are still busy harvesting soybeans.Rainfall in the Midwest regionally delayed harvest work at the beginning of the week. Overall, however, the farmers are making a little faster progress than last year. Price competition from Brazil continues to have a negative impact. As the local industry association announced, September exports are expected to be around 6.23 million tons. Although that is 600,000 tonnes less than was expected a week ago, exports are still significantly higher than the volumes of last year's September. China in particular has recently met most of its needs in Brazil. The soy export figures published yesterday are largely disappointing. But here too, the Middle Kingdom was the largest buyer. Soybean meal also rose in price over the course of the week, but soybean oil has been heading south in the last few days despite the rally on Wednesday. Soybean meal prices on the local cash markets are firmer at the wholesale level compared to the previous week.

ZMP Live Expert Opinion

Uncertainty regarding Ukraine's ability to deliver remains a dominant issue. Although the country has high production prospects, it remains to be seen whether the high harvest results will actually find their way onto the world market. The abundant supply in Brazil and the ongoing US harvest tend to weigh on the market. However, China currently appears to be purchasing high demand.