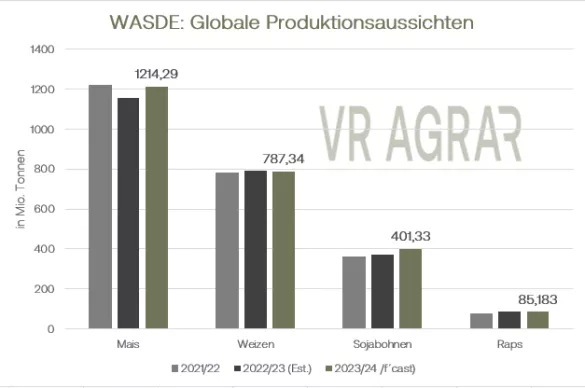

Over the course of the week, wheat prices on Euronext/Matif stabilized and increased. The current front month of December closed last Friday with a red sign at 236.25 euros/t, and yesterday, Thursday, it was 242.00 euros/t at the closing bell. At the start of today's trading day, the contracts are trending somewhat weaker again, but are above the 240 euro/t mark in the first quarter of an hour of Friday trading. Corn also started trading weaker today, but increased slightly overall over the course of the week. Yesterday the leading November closed at 214.00 euros/t. The CBoT shows a similar picture for wheat, and corn also increased over the course of the week. On the psychological side of the grain trade, the focus was once again on the events in Russia and Ukraine. After Turkish President Erdogan failed in his attempt to reach a new grain agreement, Russia is again increasingly attacking important transport infrastructure in Ukraine. Ukraine, for its part, also responded with threatened attacks on Russian agricultural infrastructure. This caused many market participants to reassess their assessment of the global supply situation.Fundamentally, the week was dominated by the USDA's September WADE, which was published on Tuesday evening. The Ministry of Agriculture put the red pencil on global wheat production and cut the production forecasts for Europe, Australia and Canada as well as Argentina. Global ending stocks were reduced by a significant 7 million tonnes compared to the August estimate to 258.6 million tonnes. For Europe, the USDA expects a wheat harvest of 134 million tons, which is 1 million tons less than was expected in August. However, more wheat is likely to be harvested in Ukraine. The US Department of Agriculture expects 22 million tonnes, an increase of 1.5 million tonnes compared to the August forecast. US production, however, was hardly changed. At the end of last week, the Russian agricultural specialist IKAR raised its forecast for the Russian harvest to 91 million tons. In central Russia in particular, yields are significantly better than initially expected, it is said. However, the large Russian harvest kept the increases in Matif and CBoT limited. Russia is currently making life difficult for the other major exporters with cheap offers.The competition is also reflected in the current export statistics. US exports are currently around 21 percent behind the previous year's result. Europe's exporters have also placed fewer quantities on the world market. The EU Commission's export count is currently 5.84 million tonnes, more than 2.1 million tonnes behind the volume that was exported to third countries up to this point in the previous year. Romania has replaced France as the largest exporter and leads the statistics. Overall, sales of grain on the local cash markets are low. Feed mixers in particular operate on sight and only ask for short-term requirements. This year's harvest has produced a high amount of forage qualities. Milling wheat qualities are stored and held back by producers in anticipation of rising prices due to a tighter supply situation in Germany. Trade in corn from the upcoming harvest is also currently quiet in this country. Buyers and producers are currently showing little interest in futures contracts. From around the 39th calendar week, market participants expect the corn harvest in Germany to begin on a large scale.In the WASDE report, the USDA certainly caused surprises and estimated US corn production to be higher than before. The ministry attributes this primarily to a higher cultivated area. The US corn harvest is expected to be 384.42 million tons. But traders have doubts about this. Weather conditions during the peak crop growth period were suboptimal in the Corn Belt and Midwest. Heat and little precipitation characterized August in particular and there is currently a lack of soil moisture and temperatures are very high for mid-September. The corn harvest in the USA has started and is slowly picking up speed. For Europe, the USDA has lowered its corn forecast by 300,000 tons to 59.40 million tons, and for Ukraine the forecast has been increased by 1.5 million tons to 28 million tons. In its monthly report, Canada's statistics office increased the production forecast there by 200,000 tonnes to 14.9 million tonnes. This could also exceed the previous year's result.

ZMP Live Expert Opinion

Concerns about the global supply situation have increased again. The fighting and the attacks on grain infrastructure are putting strain. Chances of a grain deal making a comeback are slim and recent global production cuts in the WASDE report are fueling the bulls. Nevertheless, the local supply of feed grain in particular is decent and demand is restrained. The latest data from the BMEL show that grain utilization in animal feed is declining due to declining animal populations.