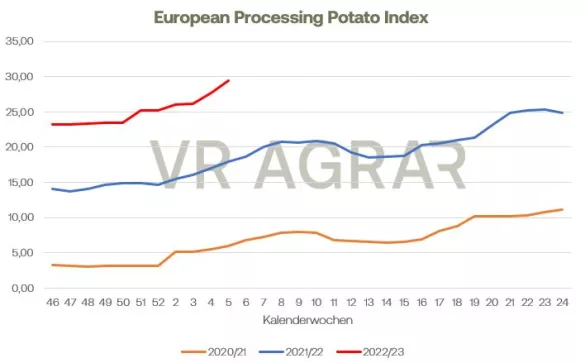

At the food market , producers are waiting for impulses. So far, these have not been forthcoming, even with the change of month. Peeling companies still show no need for free quantities and exports to Eastern Europe are still at a low level. Around Easter, it is expected that the first early potatoes from export will find their way onto German supermarket shelves. However, cultivation in Egypt and Spain has recently proved difficult. The price quotations remain unchanged. After prices for processing potatoes rose in the other countries, RNM in France has now also raised prices there significantly. Here, too, varieties such as Fontane and Challenger were quoted at 30 euros per 100 kg. Official statistics released this week show much lower potato stocks in France. Compared to the previous year, about 1 million tons are missing. The harvest volume and current stock levels are reminiscent of the drought year 2018. Compared to the values at that time, only slightly more tubers were counted this season. The Belgian factories remain very interested in free quantities and are looking both domestically and in Germany and the Netherlands.The domestic supply is too small to meet the processors' demand. In export, it is said, the Belgians can currently place good quantities. In Germany, too, the factories are working at full speed. In the short term, they are hardly looking for additional quantities, but interest is also picking up noticeably in Germany for the delivery months of April and May. As the Association of Potato Producers in Western Europe (NEPG) announced this week, factories in the four major EU countries are likely to process at least 50,000 tonnes more potatoes in the coming marketing year. On the EEX , the processing potatoes for April 2023 are somewhat weaker today, but are holding their mark of 30 euros per quintal. The EEX spot index increased significantly during price determination this week and is now quoted at EUR 29.40/dt.

ZMP Live Expert Opinion

The Belgian buyers in particular continue to take care of the home on the processing market. Despite inflation, consumer demand for frozen goods is unbroken, and there are also good export sales opportunities for the Dutch and Belgians. It looks a little different in the food market. Consumer demand is declining here, but the small harvest from the summer ensures that prices remain well above average.