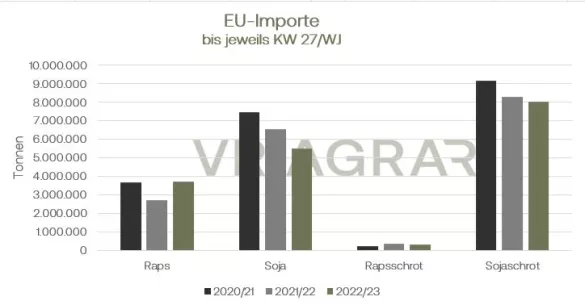

Rapeseed was volatile in the first four trading days, but the bottom line was unchanged. With a closing price of EUR 583.00 per tonne, the front month of February 2023 was back to where it had started on January 2 with the closing bell on Thursday. Canola in Winnipeg was also weaker for the week. Trading only started here on January 3rd. As announced by the Ukrainian Ministry of Agriculture, the authority assumes that farmers in the war-torn country will increasingly rely on oilseeds for spring sowing. The cultivation volumes of sunflowers, rapeseed and soybeans could benefit from this. Oilseed cultivation is currently much more attractive for local producers. The price level is high, the transport costs are relatively lower than for grain, and domestic sales are also better in some areas than for grain. As the ministry also announced, around 20 percent of the arable land in the country is either occupied by Russian troops or cannot be farmed because of mines.On the local cash markets, business is still calm, but prices have improved overall at the beginning of January compared to the beginning of December and, after the setbacks, especially at the beginning of December, have recovered significantly. Although the rapeseed meal prices are developing differently from region to region, they have recently remained largely stable. EU imports remain at a high level. As of January 3, 3.73 million tons of rapeseed were imported into the European Union. At the same time in the previous year, 2.70 million tons were still in the Commission's import statistics. The good European harvest together with the high imports ensures that the market is adequately supplied. As announced by the Union for the Promotion of Oil and Protein Plants, it assumes that the proportion of palm oil-based fuels will at least halve this year. The EU plans to phase it out by 2033, but in Germany, like in other countries, restrictions on the crediting of palm oil-based fuels for biodiesel have been in effect since this year. Accordingly, the demand for rapeseed oil should increase due to this new regulation. The soybean market only started trading on January 3rd.At the start of trading on Friday, the signs are green again, but yesterday, Thursday, soy went south. Rainfall in Argentina benefits local stocks. The harvest there typically begins in April. In Brazil, the harvest of the soy stocks is imminent. Unlike in Argentina, the weather conditions here were conducive to plant growth. The drop in crude oil prices, especially at the start of the new year, put pressure on soybean prices. The corona development in China and lower energy demand due to a mild winter in Europe have recently put pressure on the crude oil markets. High US oil inventories also put corresponding price pressure on WTI and Brent. The influence on the development of soybean prices was correspondingly negative. This Friday, the USDA will publish last week's weekly export figures. Analysts anticipate a quantity of between 400,000 tons and 1.2 million tons. This week, the USDA was able to announce an export deal for 124,000 tons of soybeans to a private buyer of unknown origin. The soybean meal prices on the CBoT were able to increase on a weekly basis.Yesterday, Thursday, the March contract closed at $464.90/short ton. Converted, CBoT scrap costs 486.11 euros per ton. On December 30, 2022, the March contract closed at a converted rate of EUR 472.86 per ton. The price increases on the CBoT in the last few days and weeks are also noticeable on the spot markets in Germany. In the course of December, prices increased steadily.

ZMP Live Expert Opinion

The start of the soybean harvest in Brazil is likely to put pressure on in the coming weeks. The current corona situation in China should at least not improve the export opportunities for the Americans. In this country, with the high rapeseed imports in Europe, an indication of good harvest results in Australia and the increased acreage for the new harvest, there is sufficient rapeseed available. The situation on the Black Sea alone is currently ensuring that rapeseed prices can remain at the high level.