The signs for rapeseed were mostly red this trading week. In the last five trading days, the oil seed of Euronext/Matif in Paris lost 8.75 euros per ton in February. It didn't help that prices rose yesterday, Thursday. With the start of trading today, there are also weaker tendencies for rapeseed again. The development on the Matif was also followed by rape quotations in Germany. Both in Hamburg in the north and in Straubingen in the south of the Federal Republic, it fell by 21 euros per ton in a weekly comparison. The current good supply situation of the local market with rapeseed continues to put pressure on the price development. EU imports remain high and the prospects for the coming harvest are good due to higher acreage, although spring and early summer will still have an impact. In the WASDE report published yesterday, the USDA essentially does not change anything in the production figures of the major rapeseed producing countries. For India, however, the report is quite surprising. The USDA experts increased the local harvest by 0.5 million tons to 11.5 million tons. That would be 5 percent more compared to the previous year's harvest.The US Department of Agriculture expects higher consumption for Europe, which is why imports have also been slightly revised upwards. With yesterday's guidance from European rapeseed and the very bullish soybean market, Canola in Winnipeg gained $10.60 to close yesterday's trading day at $842.40. Canola is still trading above the Matif rapeseed prices in Winnipeg at EUR 582.11 per tonne, but the price gap between the two oilseeds has narrowed recently. Unlike rapeseed, the soy complex was able to increase significantly this trading week. Especially yesterday, after the USDA published the January WASDE, the contracts showed up with dark green signs. With the start of premarket trading, soybean prices continue to rally on the eCBoT. Soybean meal is also firmer than a week ago, soybean oil has only moved marginally on a weekly basis. The WASDE certainly caused surprises. The USDA unexpectedly cut the US soybean harvest. The analysts were forced to make this correction because the yields per hectare in the last US harvest were significantly lower than initially assumed. The harvested area has also been revised slightly downwards compared to the last estimate.As expected, Argentina's outlook has been revised down significantly. In the South American country, the drought is having a very negative impact on both sowing and crop development. The USDA expects a harvest volume of 45.5 million tons and thus a decrease of 8.1 percent compared to the December WASDE. With the estimate, the USDA is more optimistic than the grain exchange in Rosario, Argentina. This estimated this year's forecast for the soybean harvest at 41.0 million tons. A record harvest is still expected for Brazil. However, according to estimates by the USDA, global demand is likely to be lower, particularly due to the situation in China. The global ending stocks were therefore increased by 0.8 million tons to 103.5 million tons. Support for the oilseed markets has recently come from crude oil. WTI and Brent bounced back this week after a weak start to the new year. In addition to declining inflation data in the USA, the assessments of Chinese consumption are particularly supportive for the oil markets.North Sea Brent closed yesterday at $84.48/barrel, WTI rose $1.52 to $78.98/barrel in yesterday's trading.

ZMP Live Expert Opinion

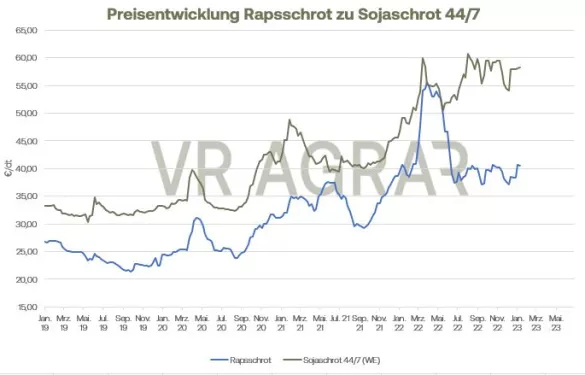

Rapeseed and soy have recently decoupled more clearly from each other. While the drought in Argentina in particular is helping soybeans and soybean meal to rise again in price, rapeseed is heading further south due to the good global supply situation. A lot will depend on the progress of the Brazilian soybean harvest and the development of demand in China in the further development. The latter in particular is unpredictable due to the strong spread of the Covid virus in the Middle Kingdom.