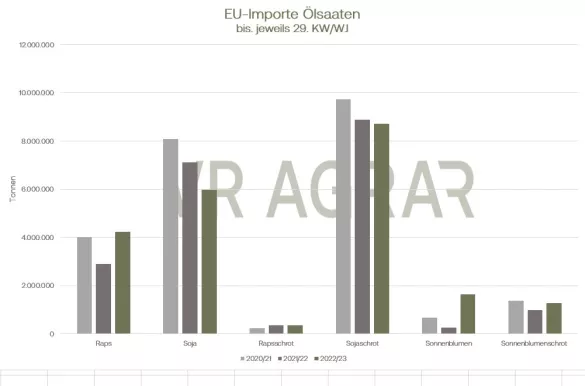

Rapeseed remains true to its downward trend this week. The most traded May contract closed yesterday with a closing price of 540.25 euros/t. Since the beginning of the year, rapeseed has lost 47.75 euros per ton in value in the May period. Soybeans on the CBoT were also weaker this week but, unlike rapeseed and canola, have strengthened year-to-date. On the soybean market, the participants are primarily looking at the situation in South America. The beginning of the Brazilian soybean harvest started more slowly than initially expected. Rainfall slows the pace of harvesting. Rainfalls are also arriving in neighboring Argentina. The drought-plagued country has experienced more precipitation in recent days than forecast by meteorologists, and more heavy precipitation is also on the radar for the weekend. Argentinian farmers are still busy soybean seeding. Around 88 percent of the targeted space has currently been ordered. The precipitation should therefore improve the prospects for the local harvest.The grain exchange in Argentina and the USDA had recently reduced the harvest quantities for Argentina and the international grain council has also reduced soybean production there. Globally, however, the International Grains Council expects significantly higher production of soybeans this season. This is mainly due to the record harvest in Brazil. Soybean meal also increased slightly over the course of the week. Soybean meal has become more expensive overall since the beginning of the year. While the March contract was quoted at 458.50 US dollars per short ton (472.86 euros/t) on January 2, the scrap was quoted at 478.10 US dollars per short ton (485.47 euros/t) yesterday. . In terms of price development, soybean meal benefited above all from the prospects for Argentina, after all the country is the largest global exporter of soybean meal. The International Grains Council lowered the global acreage estimate for the coming harvest by 6 million hectares compared to the previous year. In India, Australia and Ukraine in particular, the acreage is likely to be smaller. For Europe, on the other hand, an increase of 2% in acreage is expected.For Germany, the Federal Statistical Office determined an increase in the winter rapeseed area of 7.6 percent in December. According to the estimate, the German acreage should be around 1.2 million hectares. On the local cash markets, rapeseed sales are still low, prices for rapeseed also fell due to the clearly falling rapeseed prices on the Euronext/Matif. The rapeseed meal prices held up or were slightly weaker. As in the previous week, 338 euros/t are quoted in Hamburg. Canola in Winnipeg has also been weak recently. In particular, the prospects due to falling Chinese imports weighed on the mood of Canadian market participants. However, the overall bearish vegetable oil market environment also put selling pressure on rapeseed and canola. As of January 15, 2023, EU importers imported a total of 4.24 million tonnes of rapeseed. This means that 275,933 tons were imported in the 29th calendar week of the marketing year alone. Compared to the previous year, 1.35 million tons or 47 percent more rapeseed were imported. Rapeseed meal imports are roughly at the same level as the previous year. The EU's rapeseed oil imports are significantly lower.Imports of soybeans, soybean meal and soybean oil are lower than in the previous year. Palm oil imports to Europe have also decreased significantly. Increases can be seen in sunflower imports. Instead of 248,552 tons in the previous year, 1.64 million tons were imported up to the 29th calendar of the current marketing year, and the import volume of sunflower meal increased from 982,410 tons to 1.28 million tons.

ZMP Live Expert Opinion

For rapeseed, the good supply situation, the higher value of cultivation areas in Europe and the high import figures indicate that prices will remain under pressure. The weather in Brazil and Argentina is the hot topic on the soybean market. Forecasts for the weekend tended to put pressure on prices and prospects for the Brazilian crop are also holding back prices. The question of how imports in China will develop remains an exciting one.