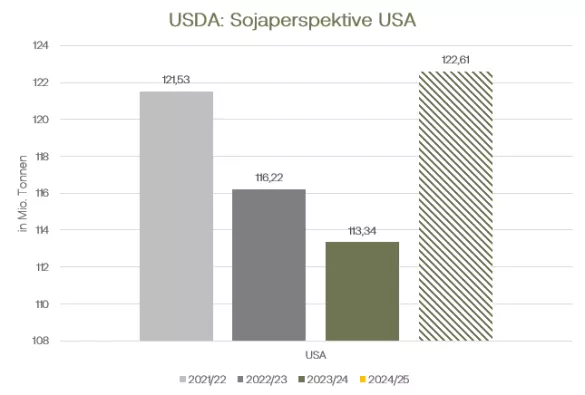

There was a strong increase in rapeseed yesterday, but there is still a noticeable loss on the list for the week. The front month of May closed yesterday at 416 euros/t, and last Friday the closing price was 427.50 euros/t. This means that rapeseed prices continue to hover around the 420 euro/t mark. On the cash markets, prices for rapeseed are mostly unchanged, while rapeseed meal shows inconsistent development. At the end of the week, the prices for animal feed usually increased slightly. There are no updated import figures for rapeseed and oilseed overall this week either. Due to technical problems, the EU Commission last decided on February 13th. updated figures published. The International Grain Council has forecast a lower global rapeseed area in an updated estimate for the coming harvest. According to this, rapeseed will be grown on 42.4 million hectares, which is around 4 million hectares more than the average of the last five years but around 700,000 hectares less compared to the previous year. If one assumes average yields, this results in an expected harvest of 87.2 million tonnes of rapeseed, up from two percent more last year. The cultivated area in Ukraine has decreased significantly. In addition to the armed conflicts in the country, poor sales revenues are particularly important for cultivation there. In Germany, Poland and Romania, the cultivated area is also likely to have been smaller due to the weather. This also confirms the observations of the Kleffmann group and the estimates of the Federal Statistical Office. Soybeans fell on a weekly basis until yesterday evening and are also showing losses in pre-market trading this Friday. Soybean meal is also trending weaker. In Argentina, rain showers improve harvest prospects. Nevertheless, the grain exchange in Rosario lowered its own forecast by a significant 2.5 million tons to 49.5 million tons. The USDA recently predicted 50 million tons of soy production for Argentina in the WASDE report. The Buenos Aires stock exchange estimates 52 million tons of soybeans. For Brazil, analysts are increasingly saying that the harvest will be smaller than the USDA last estimated. The International Grains Council (IGC) reduced its forecast for Brazil to 150.5 million tons. According to current figures, around 21 percent of the areas in Brazil had been harvested by February 10th. The Brazilian association ANEC reduced the soy export forecast for February and now expects around 250,000 tons fewer bean exports compared to February of the previous year. Today the USDA will report fresh export sales. Due to a public holiday on Monday, these will only be published this Friday and not on Thursday as usual. Preliminary estimates range from 300,000 tons to 800,000 tons.

ZMP Live Expert Opinion

The harvest in the southern hemisphere is putting soy and soy meal under pressure. Overall, the supply is there. This also applies to rapeseed. With the increased cultivation forecast for the USA for the coming harvest, oilseed prices remain under pressure, while the lower rapeseed area in Europe and globally is giving rapeseed slight support.