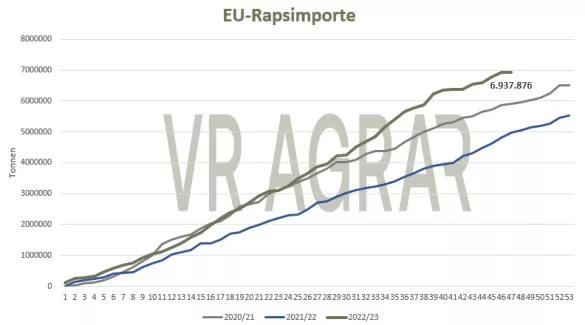

Right at the beginning of the new trading week, rapeseed went south. The psychologically important mark of 400 euros was undershot on those days in the front month of August. From the middle of the week, however, the contracts were able to move north again and regain the 400 euro mark on Thursday. The closing price for the August date was 407.00 euros/t yesterday evening at the closing bell. Cash market sales, whether for new or old crops, remain manageable. At the current prices, the producers in particular are not willing to sell and are not willing to make decisions. Data from the Federal Information Center for Agriculture on the processing figures in the last year show that self-sufficiency has increased. More quantities of oilseeds from Germany were processed domestically into oils and fats. But there will not be an oversupply in the foreseeable future either. Overall, producers in Europe are satisfied with the stock development. There are still no major reports of problems in the vegetation or pest infestation. The EU forecast service MARS increased its latest yield forecast for the coming harvest this week.Although the expected yields are a good one percent behind the harvest results of the previous year, at 3.89 tons Europe-wide, a yield that is 12 percent better than the average of the last five years is expected. Europe's imports remain at a high and steady level. Market supply is currently comfortable. The International Grains Council gave an assessment of the global rapeseed harvest this week. For Europe, the committee based in London now expects a harvest of 20 million tons (previously 19.5 million tons). This coincides with the estimate of the EU Commission, which also assumes a rapeseed harvest of 20 million tons. In Canada, the local agricultural authority AAFC reduced its forecast for the coming canola harvest by 100,000 tons to 18.4 million tons on Wednesday. Due to good export prospects, however, the ending stocks were also significantly reduced. On a weekly basis, soybeans on the CBoT went south. The influencing factors were diverse, even if individual trading days with significant profits definitely stood out. The price competition from Brazil is still strong. The industry association ANEC recently raised its expectations for exports again.At the same time, the US export front is mixed. The quantities shipped and the new export sales have recently tended to be disappointing. The renewed strength of the US dollar is also restricting competitiveness. Farmers in the US continue to make good seeding progress. In the Great Plains in particular, however, the plants will soon need precipitation, as there are already signs of low soil moisture. Soybean meal has recently fallen significantly. This was also reflected in the listings in Germany. While rapeseed meal was stable to slightly firmer due to the rather low availability of goods, soybean meal prices mostly fell at the beginning of May.

ZMP Live Expert Opinion

Brazil is in the middle of a record harvest and is putting pressure on the world market with cheaper offers. In addition, the better global outlook and the good progress in US sowing combined with rather subdued demand from China are weighing on the soybean market. The same applies to rapeseed. Although the global harvest is not growing above the level of the previous year, the availability is currently extremely good and the stocks in Europe are developing positively. Overall, the oilseed markets are under pressure, but they are always good for surprises.