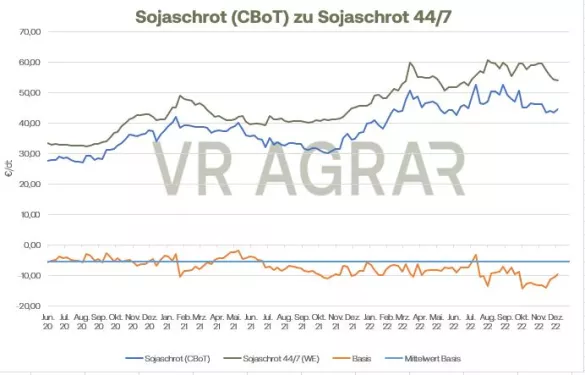

The rapeseed contracts in Paris on the Euronext/Matif are also weaker this week. On a weekly basis, all traded contracts lost. Yesterday and Wednesday, however, rapeseed was able to halt its downward trend of the past week and increased slightly for two days in a row. On yesterday's trading day, the oil seed in the most traded February contract showed a daily profit of 1.75 euros per tonne and a closing price of 571.25 euros per tonne on the Euronext/Matif display board. Canola in Winnipeg was up more significantly over the week. In Canada, the data from the statistics authority continued to have an effect this week. CanStat had estimated the harvest to be lower than what the market had expected. The difference between the statistical authority and market expectations was almost 1 million tons. The canola harvest is underway in Australia. The farmers here are satisfied with the first results, a harvest around the record level of the previous year was expected for the country Down Under. On the spot markets in Germany, the volume of rapeseed is still low. The spot market prices have also given way here on a weekly basis. In principle, support for rapeseed and canola also came from the soybean market.Soybean prices rose sharply on the CBoT this week, with double-digit daily gains on many trading days. Soybeans for the front month of January closed yesterday at 1,486.25 US cents/bu (517.14 euros/t), on Monday the beans were still at 1,437.75 US cents/bu (503.41 euros /t). Although the drought in Argentina is also having an impact on prices, the main reason for the rally in soybeans is expectations for imports from China. Although these were also significantly lower in November compared to November of the previous year, the relaxed corona measures in China are driving export expectations. The USDA was able to report retail sales of over 836,000 tons yesterday, of which at least 118,000 tons were sold to China. Weekly export sales were also above market expectations yesterday and provided strong support. The USDA recorded and reported 1.72 million tons of soybean sales in the week ended December 1st. Soybean meal increased very significantly on a weekly basis.The January contract climbed from 432.10 US dollars/short ton on Monday to 466.40 US dollars/short ton on Thursday and is thus quoted at the equivalent of 485.83 euros per ton. This development is also reflected in the cash markets. From the Hamburg station, 534.00 euros/t for soybean meal was quoted yesterday. The Brazilian agricultural authority Conab slightly reduced its own forecast for the local soybean harvest and expects a harvest of 153.48 million tons this season. Market participants are eagerly awaiting the USDA's December WASDE, which is scheduled to be published this Friday at 6:00 p.m. CET. It is expected that the production volumes for Argentina in particular will be reduced. However, it will also be interesting to see how the USDA will assess the export potential of the USA.

ZMP Live Expert Opinion

The great expectations of the harvest in Brazil are fading a little in the background of the soybean traders. Above all, export demand from China is the focus of market news. These export expectations are still more fantasy than reality. The further course of the season will show whether the soybean traders are correct in their assessment. Slacking crude oil prices are limiting soy price development a bit.