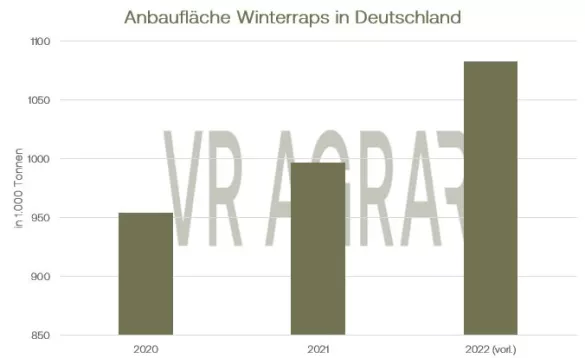

The prices for rapeseed ended their downward trend of the past week this week and increased again for the first time on a weekly basis. Yesterday, Thursday, the front month closed at EUR 573.75 per tonne. Even with the start of trading on Friday, there are initially slightly green signs. A general recovery in vegetable oil prices gave support to rapeseed in Germany. Oilseed remains very calm on the spot markets. The trading books for this year are largely closed and so the low handling volumes remain. When deals are made, the coming harvest is predominantly pre-contracted. EU imports are still above the level of the previous year, even if the momentum of imports has recently slowed down slightly. The upward correction did not affect the data from the Federal Statistical Office on autumn sowing of winter oilseed rape either. According to the figures, the area under cultivation for the 2023 harvest in Germany has increased by 81,900 hectares. This corresponds to an increase of 7.6 percent compared to the previous year. Mecklenburg-Western Pomerania remains the federal state with the largest area under cultivation, followed by Saxony-Anhalt.According to Destatis, the largest increases in area were in Saxony-Anhalt (+17,900 hectares) and Lower Saxony (+13,700 hectares). In Saxony and Schleswig-Holstein, too, the area under cultivation has grown by several thousand hectares. Because of the higher prices for canola due to last year's poor Canadian harvest and the Ukraine war, growing canola has become attractive to more and more farmers. Canaola was also able to switch back to the profit lane as a result of the increased prices on the Euronext and fundamentally positive indications for soybeans. However, the price gap between Canola on the ICE in Winnipeg and the Matif in Paris has narrowed recently. Soybeans were volatile over the week with some back and forth trading. On a weekly basis, however, there is a minus ahead of the courses. On Thursday in particular, market participants were disappointed by the export sales, which fell short of even the pessimistic estimates. In addition, precipitation in Argentina, which has been announced for the Christmas weekend, will further relax the soybean plants there. The current situation in China is also giving market participants questions.At the beginning of December, the beans were repeatedly supported by hopes of better demand from China due to the relaxed corona rules there, but many observers are concerned about the current corona situation there. The official import figures from China again showed low demand in the country for the month of November. Soybean imports continued to decline compared to October. The price of soybean meal was largely maintained over the course of the week. The rapeseed and soybean meal prices on the local cash markets have hardly changed on a weekly basis and indicate a stable development.

ZMP Live Expert Opinion

The market participants are increasingly focusing on the situation in South America. The damage from the drought is likely to be alleviated later by the announced precipitation and thus not drive up the harvest prospects significantly, but improve them nonetheless. The plants in Brazil are developing well, there is nothing to prevent a punctual harvest from the end of January. The situation in China will also continue to occupy the soybean markets, and in the case of rapeseed, the better global supply and the increased acreage in Germany should tend to continue to put pressure on them.